TurnKey Lender System can be integrated with third-party solutions like Adobe Sign to enable documents' e-signing.

Restrictions

The Agreement Signature feature only works for loans with a single system-generated document that's considered a loan agreement. If there are no documents registered in the system (or multiple system documents exist for a loan), the system will display an error.

Every system Document type should have a marker: 'Send for signing' Yes/No

Once a loan gets Signing status, all documents with enabled signing are prepared and sent to the customer.

Loan Status is changed to Approved if only all docs are signed

(contact your TurnKey Lender account manager if you're not sure about the items on the list above)

System settings

For e-signing to work, the System workplace should have the following settings:

Enabled - enables/disables the e-signature functionality. If disabled, loans won't require agreement signature before proceeding to disbursement;

Reminder period - the period (in days) after which the system automatically sends a reminder to e-sign the agreement to the Customer (if it wasn't signed before);

Expiry period - the period (in days) after which the document signature is no longer possible. Once expired, the loan is automatically closed.

E-signing workflow

Once the loan is approved, it's assigned Signing status and loan agreement is sent for signature using the configured third-party service. The services typically send an email to the borrower with instructions on how to sign the document.

There are three outcomes:

The borrower signs the loan agreement. In this case, the loan is assigned the Approved status. This means it's ready for disbursement.

The borrower declines the loan agreement. In this case, the loan is closed with Agreement Declined status and is sent to Archive.

The loan agreement is neither signed nor declined within the Reminder Period. In this case, the system sends a notification to the borrower saying that the loan agreement needs to be signed. The notification is sent once every Reminder period (set in days) while the agreement is waiting for the signature. After the Expiry Period passes, if an agreement isn't signed, the loan is closed with Agreement Expired status and is sent to Archive with the corresponding notification to the customer.

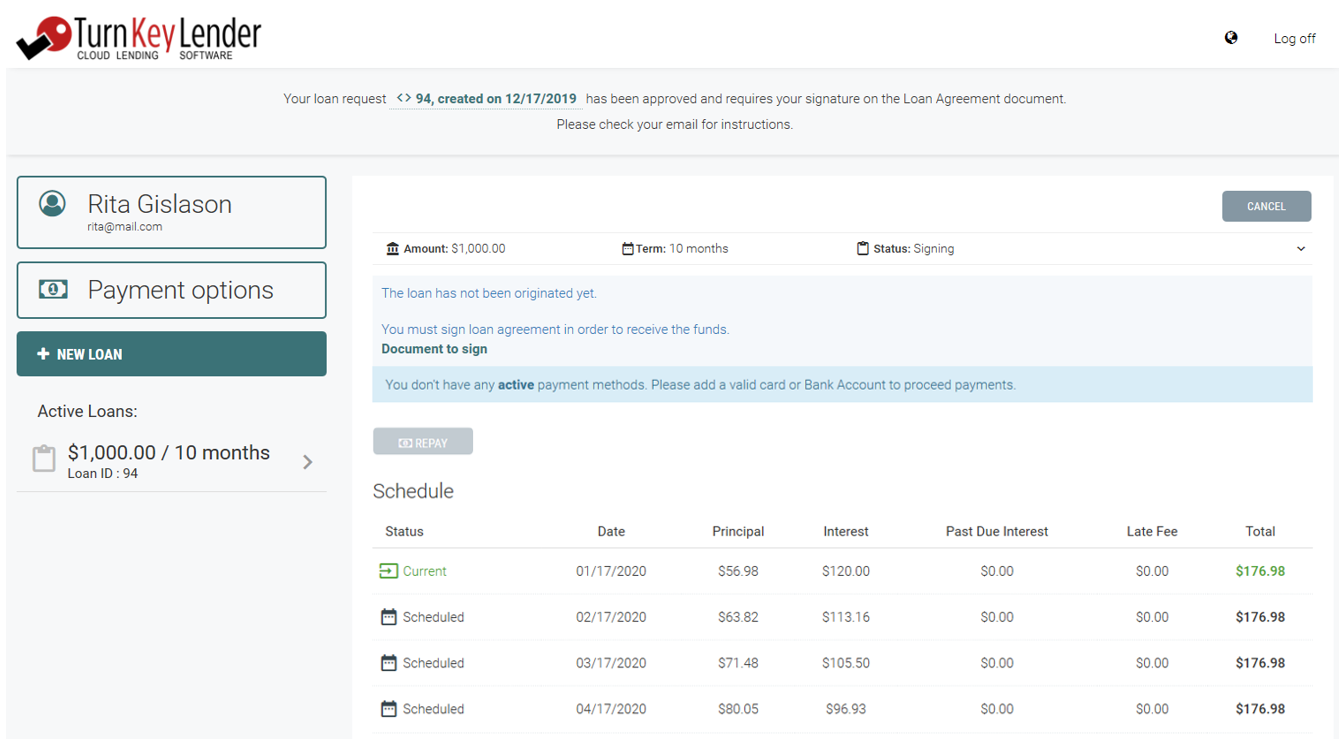

Front-office

If the borrower's last loan is waiting for agreement signature, the Information area notifies the customer that they must sign the agreement.

For all the loans that need a signature, the Loan details section shows the message "The loan has not been originated yet. You must sign loan agreement in order to receive the funds."

Back-office

Loans with Signing status are displayed in the Underwriting workplace. An underwriter can forcibly reject and black-list loans with this status.

If documents' signature is enabled by a Back-office user, they can see dates of signatures of the system documents.

Back-office user can prevent automatic signing by enabling the Manually Sign function (given that e-signing solution is integrated and enabled).

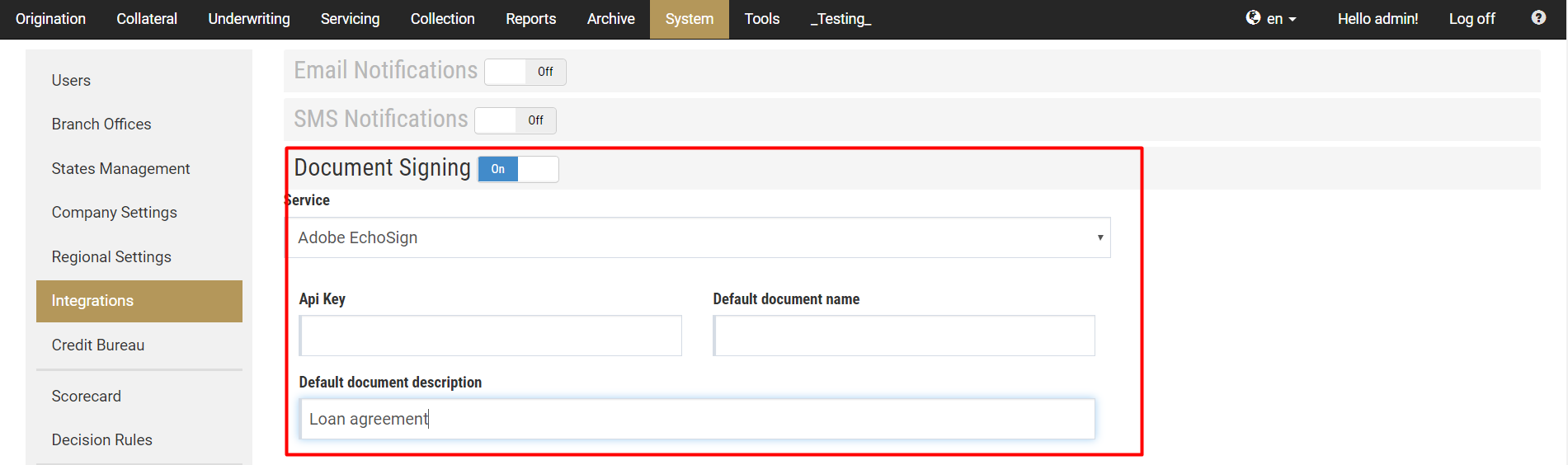

E-sign services integrations

The system offers Users several options for enabling e-signatures. The solutions that easily integrate with TurnKey Lender include:

Adobe Sign

eSignLive

Sign Now

SMS

Credentials are configured in System > Integration.