To unify all of your lending business in TurnKey Lender , you can allows companies to import external data batches with customers, loans, or payments to your TurnKey Lender portal. The data import process includes external data transfer, error checking and fixing, and import of the necessary info.

...

Navigate to Tools > Import to access the functionality.

...

that contain the details of different system components and entities without API (as Excel files). This article contains a brief overview of the import processes. Please see its child articles for more details descriptions of each type of import.

Import Screens

To run the import:

Go to Tools → Import

...

Select what you want to import (Customers, Loans,

...

etc.).

Click the Download template button.

Open the template and fill

...

the data into the Excel file

...

Then upload the .XLS or .CSV file to the System in the same window.

The import consists of 3 steps in the following order:

Customers

General information:

To import customers into the System, you need to get the Excel template ('Download template' button) fill the file with your data, and upload it (‘Chose file’ button).

After that, preview import results to fix any errors and see if all the records were processed successfully. New customers won’t be created in the System unless you confirm the import.

Photos and documents can't be migrated via customer import. In case photo and documents are required, customers will be created and assigned status Incomplete. Please, check the Application form section to adjust these settings. If required fields are empty, customers will be assigned status Incomplete and the general loan flow will not be applied for them.

Only email is required for Customer creation. If the field is required in the application form but is empty in the load file, Customer will be created with status 'Incomplete'.

Once loans have been imported the Popup message 'Customers imported successfully' appears.

Example ‘customers_template’ file below:

The 1 st Customer will be created with ‘Incomplete' status. You can complete the creation of the Customer from Tools-> Customer management tab.

The 2 nd Customer will be created with ‘Active’ status

2. Loans

General information:

To import loans into the System, you need to get the Excel template ('Download template' button), fill the file with your data, and upload it (‘Choose file’ button).

After that, preview import results to fix any errors and see if all the records were processed successfully. New loans won’t be created in the System unless you confirm the import.

Loans are created in Origination status if Disbursement date empty.

Loans are created in Active/Past due status if Disbursement date is filled.

Once loans have been imported the Pop-up message 'Loans imported successfully' appears.

Loan ID column is added to the export excel file.

Example ‘loans_template’ file below:

The 1st Loan:

First Payment Date can't be earlier or equal Disbursement Date.

First Payment Date can't be earlier or equal Start Date.

The 2nd Loan:

Loan Amount does not correspond to Credit product.

Loan Term does not correspond to Credit product.

First Payment Date can't be earlier or equal Disbursement Date.

First Payment Date can't be earlier or equal Start Date.

The 3rd loan will be ready for import

Loan ID column is added to the export excel file.

You will find this loan on the Servicing Workplace by Loan ID with Active Status because of the filled Disbursement date.

The 4th loan will be ready for import

Loan ID column is added to the export excel file.

Loan is created in Origination Workplace with Origination status because Disbursement date is empty.

3. Payments

General information:

Payments can be imported for loans in Active or Past Due, waiting for Initial payment statuses. The payments parameters must match the loan (amount, date, loan status etc).

Date: Date can't be in the future and Payment date can't be earlier then disbursement

Once Payments have been imported the Pop-up message 'Payments imported successfully' appears

Example ‘payments_template’ file below:

The 1-st Loan will appears on the ‘Archive’ WP with ‘Repaid’ status because of full payment.

The 2-nd Loan will appears on the Servicing WP with ‘Active’ status.

...

. Mandatory fields are marked with an asterix.

Click Choose file and upload the file with data into the system.

For more details please see Work with Excel Files to Import Data

Import Flows

There are three basic import flows:

Importing existing disbursed loans

Importing loan applications on which disbursement has not yet been performed

Importing dictionaries

Importing Existing Disbursed Loans

If a loan has already been disbursed, there is no need for the system to check customer details and risks. In this case, it is enough to:

1. Import Customers

Import details of the Customers, for which loans will be added. The only mandatory field is the customer e-mail. If the customer already exists in the system, you may skip the step. For more details see Import Customer Batch

2. Import Loans with Disbursements

Import details of the loans. Mandatory fields include:

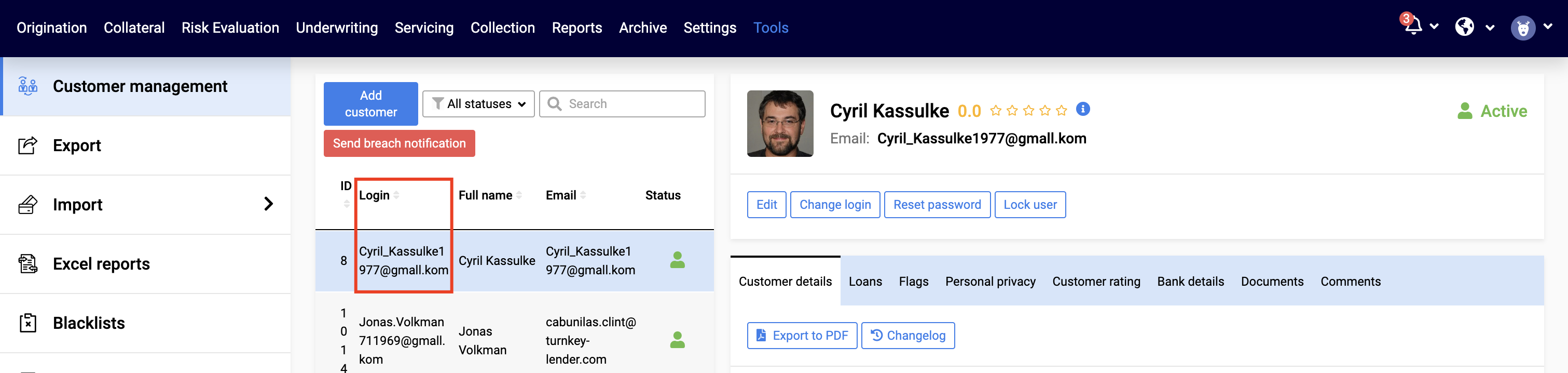

Login: Customer’s login. You can see it in the Tools → Customer Management → Login

Credit product: Name of the credit product as specified in the Setting → Loan Settings → Credit Products

Loan amount: Amount of the loan

Loan term: How long the term is, where Value is the number of units, and Periodicity is the units, e.g. for a loan term of 6 month, the Value = 6 and Periodicity = Month, for a loan of 2 years, the Vaule = 2 and Periodicity = Year

For the system to know that the loan has been disbursed, you need to include details of the disbursement, even though they are not marked as mandatory. These details correspond to details of the disbursement in the UI

For more details please see Import Loan Batch

3. Import Payments

Once loan is added to the system as active, you can Import Payments. Payment details correspond tot he details of the disbursement in the UI.

For more detail please see Import Payments

When a credit line is added to the system, the Disbursement information shall be left empty. It can then be registered in the system with the Disbursement Batch Import. This means, that in order to import active credit lines, you need to complete all the obligatory customer details first (either via import or via UI) |

Importing loan applications on which disbursement has not yet been performed

When a new loan is imported, it is important for the system to have enough information for its further processing. Therefore, you can

Provide all necessary information during the import: The loan will be created in Origination or Underwriting status (subject to your business flow)

Provide part of the information: The loan will be created in Pre-Origination statua and will require additional details

For such loans, after customer and loan details have been imported, you can additionally import disbursements. (see Import Disbursements Batch )

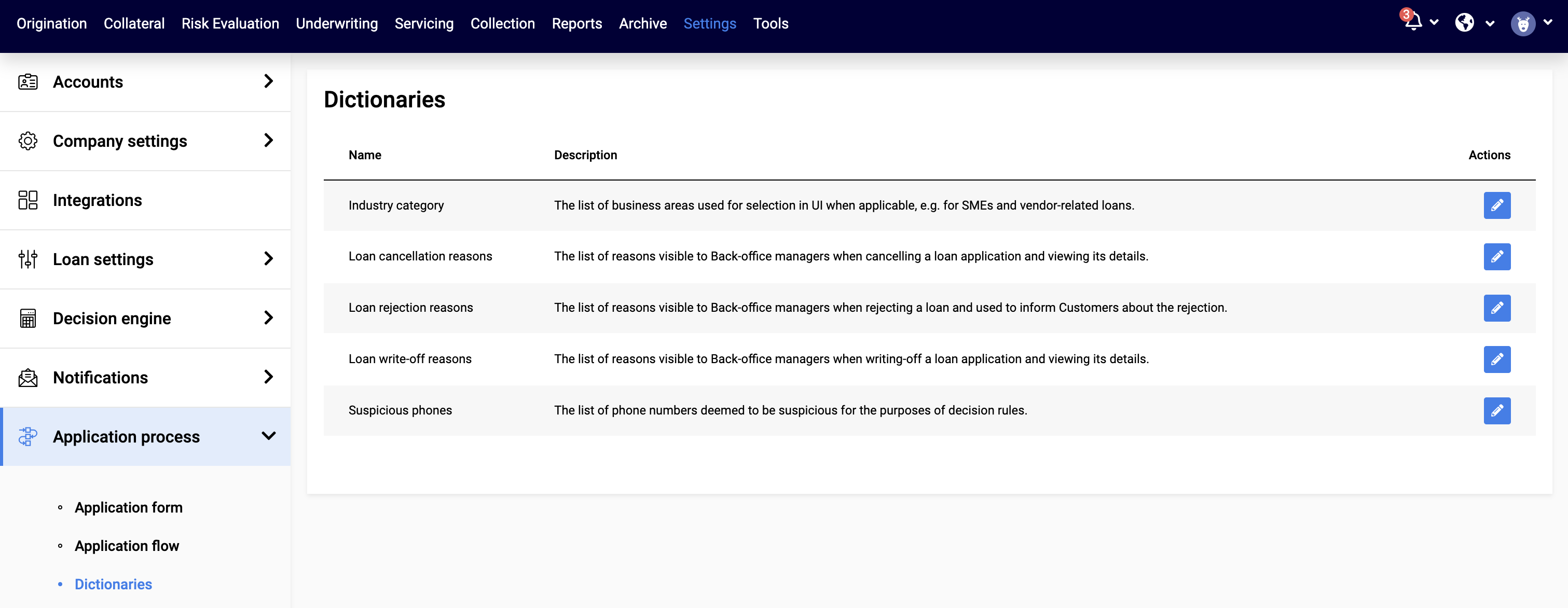

Importing Dictionaries

...

Write-off reasong, cancellation reasons, rejection reasons, suspicious phones and industry categories can also be imported via Excel files.

These are the same lists that can be defined from the Settings → Application process → Dictionaries.

Before you import the template pay attention to the option of sending notifications to customers. It is recommended to disable any notifications while you’re importing customers, otherwise, they will receive non-relevant notifications regarding loans, which may confuse them. For example - you have imported disbursements already but haven’t imported re-payments yet. A lot of loans will go to Past due state and customers will receive notifications regarding their debt, which won’t be accurate |

...

| View file | ||

|---|---|---|

|

...

. |

...