Release 6.3 (28 August 2018)

Facebook and Google Authentication

Borrowers and investors can now register and log in using their Facebook or Google account.

GDPR Compliance

Now our application is GDPR-compliant. This includes receiving consents from the user, user’s ability to erase personal data, breach notification system and more. The UI related to GDPR compliance is optional and may be enabled only for EU customers.

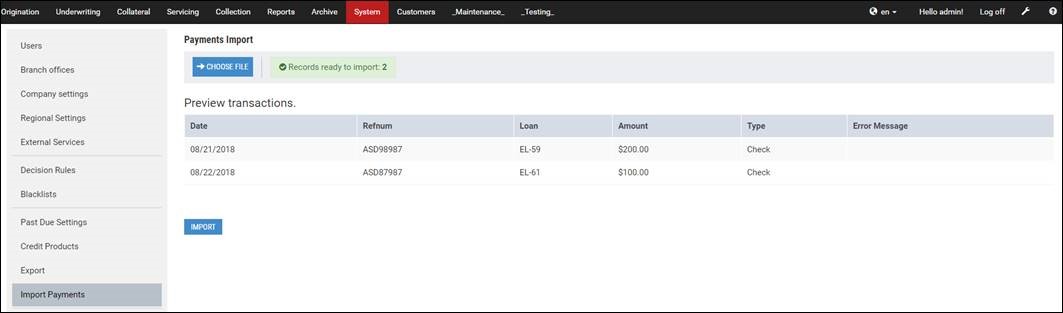

Batch Import of Repayments

Loan manager or admin can now perform a batch import of payment transactions from an external system by uploading an XLS or CSV file that meets our format. After that, all payment transactions are automatically applied to corresponding loans, balances are updated.

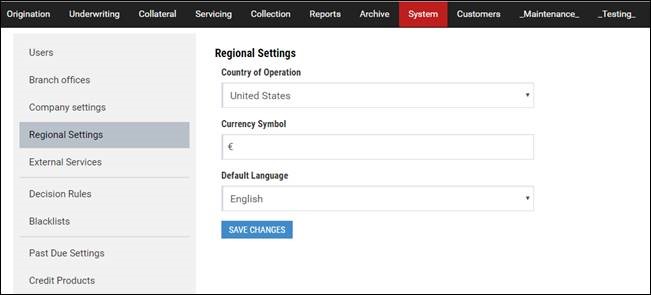

Regional Settings

Now Back-Office admin can define regional settings for the system. These include Country of operation (defines date/number formatting rules as well), currency sign and preferred language

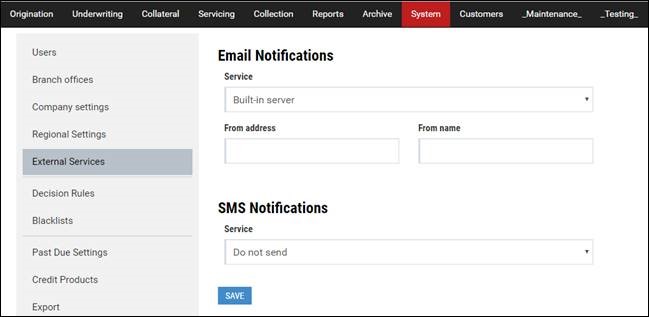

Management of External Services

Now admin can manage what services to use for payment processing, email and SMS notification, document signing. If a service integration requires additional parameters, they can be entered via the UI as well.

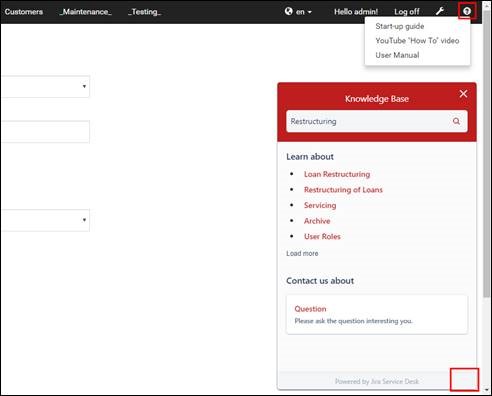

Links to Help, Videos and Knowledge Base Lookup

Back-office users can now directly access user manual and tutorial videos using the Help button. Also we have integrated a Jira widget that allows direct search in our knowledge base right from the application.

Investments from Back-Office

Now loan manager can add, modify and withdraw loan investments on behalf of any registered investor

Two Company Logo Images

Company logo can now be uploaded in 2 versions: square logo for favicons and full-size non-square logo for the Home page.

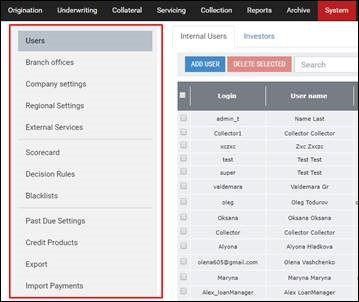

System Menu Reorganized

The System menu of the Back-Office application is now organized into groups for easier navigation

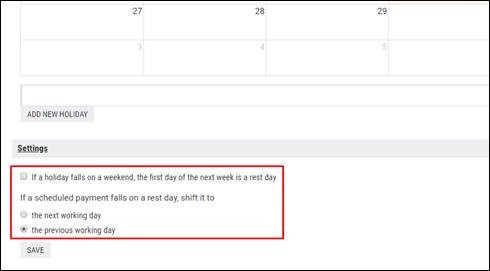

Additions to Calendars

Optional holiday sliding, customizable rules for shifting loan repayment dates that match holidays or weekend.

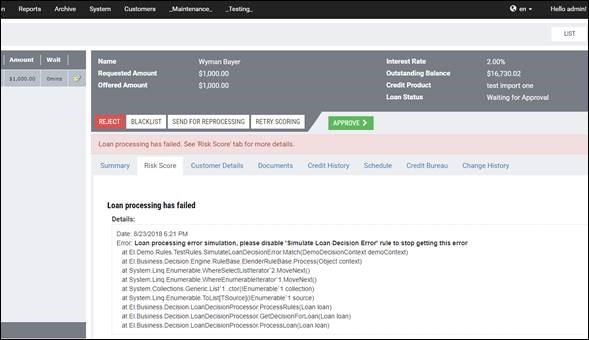

Loan processing errors handling

Now, if loan processing fails (e.g. due to unexpected credit bureau request failure), such loan is forcibly moved to the Waiting for Decision status and error details are displayed to the user.

White-Labeling (Hiding all references to “Turnkey Lender”)

White-labeling of the system. Removes all references to Turnkey Lender from the UI. Can be enabled using a system option (disabled by default).

Design Improvements

Various minor UI design improvements have been done on both back- and front-office sites.

Performance Optimizations

System performance has been optimized in various use-cases, especially for slow network connections (traffic amount significantly reduced).