Adding a New Credit Product

This subsection describes the procedure of adding a new credit product to the system.

The user with the Administrator role can create a new credit product with required parameters. A created credit product can be selected by the Originators for creation of loan applications or by the borrowers applying for the loan online.

To create a new credit product:

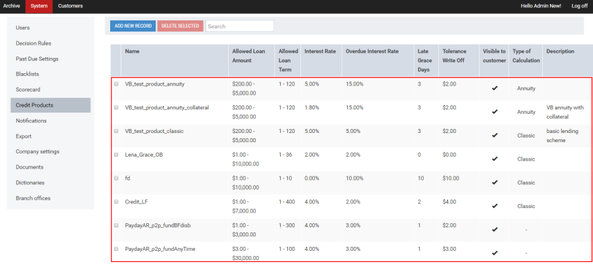

1) In the option menu to the left, click Credit Products.

The list of all credit products previously created is displayed in the table:

2) Above the table, click the Add New Record button.

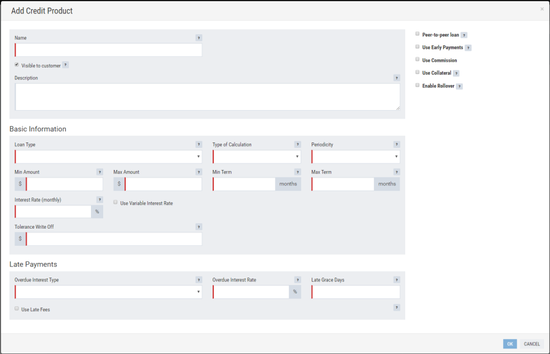

The Add Credit Product window opens:

3) In the Name box, specify a name of a credit product.

4) (Optional) Select the Visible to customer check box to display the credit product for the borrower applying for the loan online.

Note: | At least one credit product visible to the borrower must be available in the system. |

5) In the Loan Type box, select a loan type:

Payday loan;

Regular payments.

6) In the Min amount box, specify a minimum loan amount.

7) In the Max amount box, specify a maximum loan amount.

8) In the Min Term box, specify a minimum credit period in months.

9) In the Max Term box, specify a maximum credit period in months.

Note: | If the Regular Payments option is selected in the Loan Type box, the minimum and maximum credit period is specified in months. Otherwise, if Payday Loan is selected in the Loan Type box, the minimum and maximum credit period is specified in days. |

10) In the Type of calculation box, specify a method according to which loan parameters will be computed:

Classic;

Annuity.

Note: | The Type of calculation box is available only for installment loans (i.e. if the Regular Payments option is selected in the Loan Type box). |

11) In the Periodicity box, specify a payment frequency:

Monthly: the payment will be effected once a month;

Semi-Monthly: the payment will be effected twice a month;

BiWeekly: the payment will be effected once a fortnight.

Note: | The Periodicity box is available only for installment loans (i.e. if the Regular Payments option is selected in the Loan Type box). |

12) In the Interest Rate box, specify a monthly interest rate.

Note: | If the Regular Payments option is selected in the Loan Type box, the monthly interest rate is to be specified. Otherwise, if Payday Loan is selected in the Loan Type box, the daily interest rate is to be specified. |

13) (Optional) Select the Use Variable Interest Rate check box to allow the Originator to specify an interest rate when creating a borrower's loan application.

If the Use Variable Interest Rate check box is selected, specify the following data:

a. In the Min Interest Rate box, enter a minimum interest rate that can be specified by the Originator when creating a loan application;

b. In the Max Interest Rate box, enter a maximum interest rate that can be specified by the Originator when creating a loan application.

14) In the Tolerance Write Off box, specify a debt amount below which a loan will be automatically written off.

15) In the Overdue Interest Type box, select one of the following types:

Note: | A selected interest type will be applied after corresponding late grace days expire (see step 18 below). |

Principal debt: the interest will be charged for a total outstanding principal loan amount.

Outstanding balance: the interest will be charged for a total outstanding balance.

Current debt: the interest will be charged for a current outstanding installment.

Note: | This debt option is available only for installment loans (i.e. if the Regular Payments option is selected in the Loan Type box). |

16) In the Overdue Interest Rate box, specify an interest rate that will be applied for past due loans.

17) In the Late Grace Days box, specify a period during which the installment can still be repaid without penalties. This period starts after a due date. During late grace days, neither the overdue interest rate nor late fees are charged for non-repayment of the loan on the due date and the debt is not subject to collection.

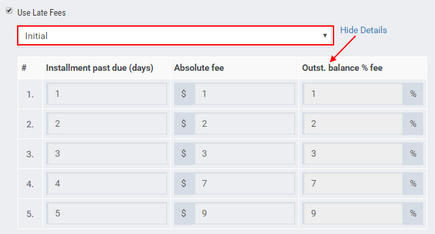

18) (Optional) Select the Use Late Fees check box to add a late fee plan to the credit product.

a. In the displayed box, select a late fee plan.

b. (Optional) Click Show Details to view details of the selected late fee plan.

19) (Optional) Select the Peer-to-peer loan check box. In this case, This credit product will be used for creating peer-to-peer loan applications.

If the Peer-to-peer check box is selected, specify the following data:

a. In the Investment Interest Rate box, specify an interest rate based on which an investor's interest will be calculated. This value is commonly less than a regular interest rate (see step 13 above).

b. In the Workflow box, select a method according to which peer-to-peer loans will be invested:

Fund before disbursement: peer-to-peer loans can be funded only before disbursement. These loans cannot be disbursed to the borrower until they are fully funded by investors.

Once a peer-to-peer loan of this type has been processed by the Underwriter (and the Collateral Manager in case of a secured peer-to-peer loan), it gets displayed in the Gathering Investments section on the Servicing workplace until investors fund it in full. Once the peer-to-peer loan has been funded in full, it can be disbursed to the borrower. After this loan has been disbursed, investors can neither change nor withdraw their bid and no new bid can be made by investors.

Fund anytime: peer-to-peer loans can be disbursed right after they have been approved by the Underwriter (and the Collateral Manger in case of a secured peer-to-peer loan) and no intermediate status for gathering investments is used for this type of loans. Once approved, these peer-to-peer loans can be funded by investors any time until they are fully repaid or fully funded.

20) (Optional) Select the Use Early Payments check box.

In this case, an amount of the advance payment received from the borrower will be processed before a scheduled payment date and will be applied to a corresponding installment.

If the amount of the advance payment received is less than the installment amount due, the installment can be covered partially in two ways depending on the following settings:

If the Interest calculation based on initial principal option is selected, the outstanding interest amount remains unchanged.

If the Interest calculation based on reduced principal option is selected, the outstanding interest amount changes depending on the total outstanding principal amount.

21) (Optional) Select the Use Commission check box and specify the following data:

Admin. Fee: a fixed fee amount applied to each installment in the payment schedule. A specified amount will cover administrative costs.

Admin. Fee (%): a percentage of a loan amount to be applied to each installment in the payment schedule as a relative fee amount for covering administrative costs.

Origination Fee: an absolute fee amount for granting a loan. This fee amount does not depend on a loan amount. The absolute fee amount will be included into a total amount due for the first installment in the payment schedule.

Origination Fee (%): a percentage of a loan amount to be used for calculating a fee amount for granting a loan.

22) (Optional) Select the Use Collateral check box to provide for the possibility to create loan applications with collateral.

a. If the Use Collateral check box is selected, specify a maximum Loan To Value (LTV) ratio in the Max. LTV box.

23) (Optional) Select the Grace Period check box to specify a grace period.

Note: | The Grace Period check box is displayed if the Monthly periodicity is selected for regular payments. The Grace Period check box is unavailable for the payday loan type. |

The grace period is a period during which a principal loan amount is not repaid. This period begins immediately after the loan origination date and due dates of all scheduled installments are shifted by a grace period term.

If the Grace Period check box is selected, specify the following parameters:

Grace period: a number of months;

Grace period type:

No interest: the borrower will not make any loan repayments during the grace period.

Interest only: the borrower will pay only interests and the administration fee (if applicable) during the grace period.

24) (Optional) Select the Enable Rollover check box, to allow a loan extension.

If the Enable Rollover check box is selected, specify the following parameters:

Minimum term: a minimum rollover period;

Maximum term: a maximum rollover period;

Maximum allowed rollovers for loan: a maximum possible number of rollovers.

25) In the Add Credit Product window, click OK to complete the creation of the credit product.

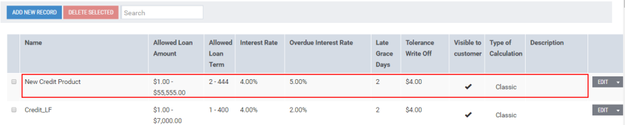

The credit product has been successfully added to the system and gets displayed in the list of available credit products: