Setting a Custom Scorecard

This subsection provides instructions on how to set a custom scorecard.

Setting of the custom scorecard comprises the following stages:

Specifying scoring characteristics: loan application parameters that influence the score assigned to the borrower;

Specifying risk segments: risk groups into which the scorecard is segregated depending on the score. Each risk group is characterized by a corresponding risk level.

These procedures are described in details in the subsections below.

Specifying Scoring Characteristics

This subsection provides instructions on how to set scoring characteristics according to which the borrower's data will be evaluated.

To set scoring characteristics:

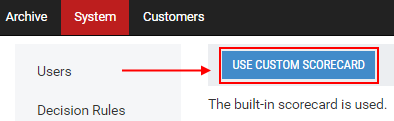

1) In the option menu to the left, click Scorecard.

2) Click Use Custom Scorecard.

The Scoring Characteristics tab of the scorecard opens:

3) (Optional) Remove the check mark next to scoring characteristics that will not be used in the scorecard.

Note: | By default, all scoring characteristics are selected. |

The following scoring characteristics are available for the evaluation of loan application data:

Marital status;

Number of dependents;

Education;

Company size;

Job title;

Employment duration;

Income type;

Apartment or other property in possession;

Debt to income ratio, %;

Credit bureau score.

Each of the above specified scoring characteristics has a number of categories to which appropriate score points must be assigned.

4) Assign appropriate score points to categories of a required characteristic:

5) (Optional) If necessary, add categories to a corresponding characteristic by clicking the Add Category button.

Note: | Only numeric categories can be added, namely categories can be added to the following characteristics: |

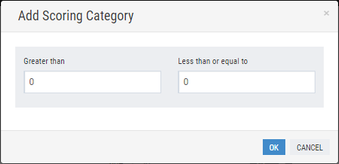

The Add Scoring Category window opens:

a. In the open window, specify required values in the Greater than and Less than or equal to boxes and click OK to save changes.

6) (Optional) Click Reset to return to settings that have been saved last.

7) (Optional) At the top of the workplace area, click Collapse All to review categories of characteristics with assigned score points in the collapsed view mode.

Note: | To return to the default view move, click Expand All. |

8) Click the Risk Segments tab and set risk segments as described in the Specifying Risk Segments subsection below.

Specifying Risk Segments

This subsection provides instructions on how to set risk segments into which the scorecard will be divided depending on the score.

To set risk segments:

1) Repeat the relevant steps of the procedure described in the Specifying Scoring Characteristics subsection above.

2) Click the Risk Segments tab.

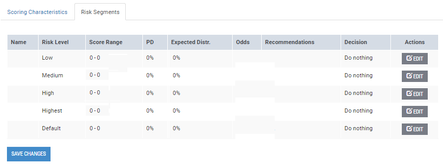

The Risk Segments tab displays a number of risk segments characterized by a risk level:

Low;

Medium;

High;

Highest;

Default.

3) Opposite a risk segment to be set, click Edit.

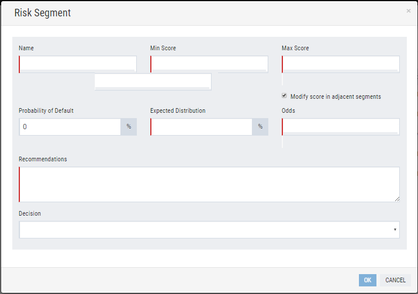

The Risk Segment window opens:

4) In the open Risk Segment window, specify the following information:

Name: a risk segment name;

Min Score: a minimum score point;

Max Score: a maximum score point;

Probability of Default: probability of default on the borrower's loan in percentage terms;

Expected Distribution: the expected percentage of "bads" in a corresponding score range;

Note: | "Bads" are delinquent loans with the overdue period exceeding a value specified by the Administrator in settings (exceeding the value specified in the first interval: for more information, refer to the Delinquency Settings subsection below). |

Odds: odds of loan repayment;

Recommendations: recommendations with regard to the risk segment. Specified recommendations will be visible to the Underwriter.

Decision: a system decision on the scorecard:

o Approve: the system recommends approving the loan application.

o Reject: the system recommends making a negative decision on the loan application.

o Refer: the system cannot make a definite decision on the loan application, additional processing is required by the Underwriter.

5) (Optional) Remove the check mark next to Modify score in adjacent segments to cancel automatic adjustment of the score in adjacent risk segments.

By default, the option is selected. In this case, score ranges specified in adjacent risk segments will be automatically adjusted if their values overlap with values specified in This risk segment.

6) In the Risk Segment window, click OK to save changes.

The risk segment has been set.

7) Repeat steps 3-6 of this procedure to set other risk segments.

Note: | When setting other risk segments, score ranges must not overlap. |

The risk segments have been successfully set.