Below you can find instructions that will help you start online lending, from the moment you apply for your instance to the moment when you register your first loan application.

| Table of Contents |

|---|

Required configuration

Step 1. Login

Log in to the system (step-by-step instructions).

| Tip |

|---|

You can find the login credentials (Login | Password) in the introduction email. Such initial user account has all the /wiki/spaces/KB/pages/315555913, including the Admin role and, if applicable, the Owner role. |

Step 2. Users

Create user accounts for your employees (step-by-step instructions).

Step 3. Credit Products

Create Credit Product(-s) (step-by-step instructions).

| Note |

|---|

Credit products are the most important part of your lending operation. All your rates, charges, and amounts are determined there. |

Step 4. Document Templates

Upload Loan Agreement templates (step-by-step instructions).

| Note |

|---|

Turnkey Lender supports automatically generated agreement documents based on your custom templates. |

Step 5. Notifications and Reminders

Check out the notifications and due date reminders and adjust, if necessary (step-by-step instructions).

Step 6. Integrations

Set up your mailing server and, if necessary, SMS service provider.

Step 7. States

(US Edition only) Set up NSF fee and APR for your states of operation (step-by-step instructions).

Congrats! All set. Now you can create your first loan application.

Extended configuration

...

| Tip |

|---|

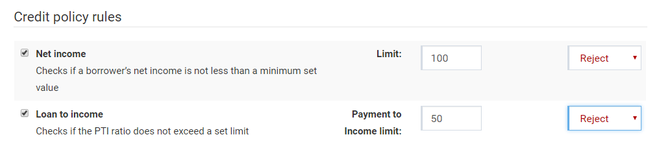

To get a feel of how powerful the decision rule engine is, you may want to begin with activating the Net income and Loan to income rules. With just these two rules enabled and properly set you can significantly reduce the volume of manual processing on the Underwriting stage. |

...

Welcome to the world of automated loan servicing and processing with the TurnKey Lender platform. Before you start using the system to manage loan applications and service existing loans, let's take a moment to see how to set up your TurnKey Lender account and adjust it to your company’s needs.

First Steps

Obviously, no loan management application can be used if there are no users to use it or no credit products to offer. The following steps are required before your company can enjoy the benefits of loan management and servicing automation with TurnKey Lender.

Login: Log in to the system using the credentials from the introduction email. The initial credentials are provided for a "superuser" who has all the possible permissions applicable to your account.

Accounts: Populate the system with users and define their permissions; Optionally, you can also add investors (if applicable) and map your company structure to TurnKey Lender branches to manage the data available to users assigned to a specific branch.

Credit Products: Add credit products that meet your company’s needs. Define the schedule rules, commissions and fees, pay-off and overpayment settings, and other details of your credit product(s).

Company-Specific Settings: Adjust the look of the application, formats, and display settings, subject to your company’s needs and location. For US companies it’s also possible to define the list of states where specific credit products can be available.

Import More Data

When starting TurnKey Lender for an up-and-running loan provider, you can import information about existing customers, investors, loans, disbursements, and payments.

More Customization and Automation

Integrate the system with additional service providers. Integrations play an important part in TurnKey Lender. For example, in order to send emails you’d need an integration with a mailing server, SMS notifications won’t reach the customer if there is no integration with the SMS service provider, and the use of in-application payments requires integration with a payment service provider, and neither soft nor hard pull is possible without and integration with a credit bureau service provider. See what integrations are available and select the ones that match your company’s needs.

Adjust the scoring cards and decision rules and TurnKey Lender will automatically reject or accept loans, or send them for further manual review subject to your requirements.

Set up your calendar to make sure the business and non-business days in the system suit your schedule and create corresponding rules not to schedule payments on days off.

Adjust the application form to gain the information you need from the customer.

Create document templates (in particular, loan agreement templates) and email templates using an extensive set of merge fields.

Adjust the notifications and reminders for customers, back-office users, vendors, and investors.

Even More Capabilities

TurnKey Lender is a highly customizable platform, and the settings of each specific functionality such as Vendor and Store settings, report-builder, debt collection rules, etc. All such settings are described in detail in a corresponding section.

Use TurnKey Lender’s API.