TurnKey Lender allows companies to import external data batches that contain the details of different system components and entities without API (as Excel files). This article contains a brief overview of the import processes. Please see its child articles for more details descriptions of each type of import.

Import Screens

To run the import:

...

Select what you want to import (Customers, Loans, etc.).

Click the Download template button.

Open the template and fill the data into the Excel file. Mandatory fields are marked with an asterix.

Click Choose file and upload the file with data into the system.

For more details please see Migrate Customer Data Into TurnKey Lender via Import

Import Flows

There are three basic import flows:

...

If a loan has already been disbursed, there is no need for the system to check customer details and risks. In this case, it is enough to:

1. Import Customers

...

Import details of the Customers, for which loans will be added. The only mandatory field is the customer e-mail. If the customer already exists in the system, you may skip the step. For more details see Import Customer Batch

2. Import Loans with Disbursements

...

Import details of the loans. Mandatory fields include:

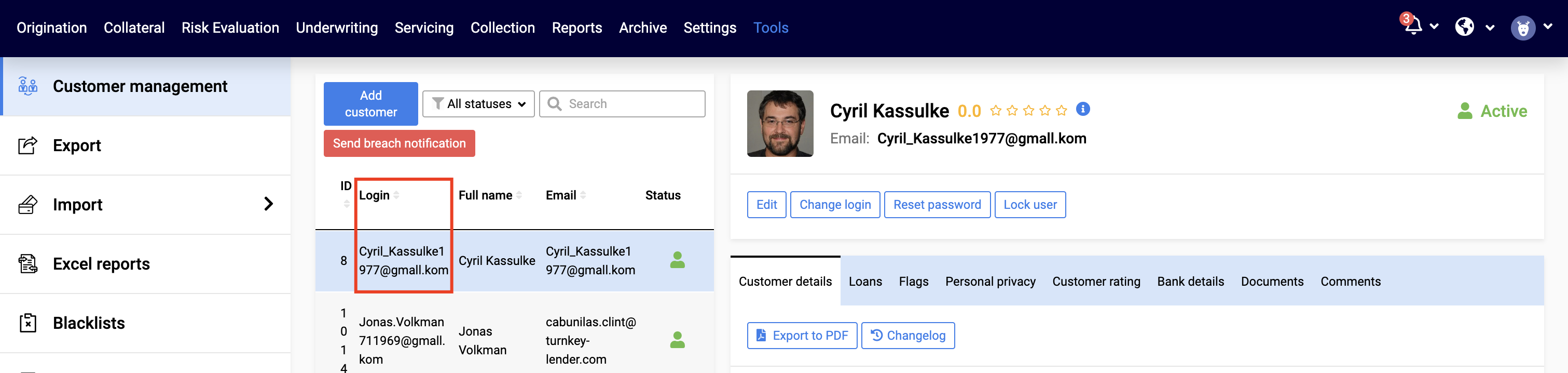

Login: Customer’s login. You can see it in the Tools → Customer Management → Login

Credit product: Name of the credit product as specified in the Setting → Loan Settings → Credit Products

Loan amount: Amount of the loan

Loan term: How long the term is, where Value is the number of units, and Periodicity is the units, e.g. for a loan term of 6 month, the Value = 6 and Periodicity = Month, for a loan of 2 years, the Vaule = 2 and Periodicity = Year

For the system to know that the loan has been disbursed, you need to include details of the disbursement, even though they are not marked as mandatory.

These details correspond to details of the disbursement in the UI

...

...

For more details please see Import Loans Batch

3. Import Payments

Once loan is added to the system as active, you can Import Payments. Payment details correspond tot he details of the disbursement in the UI.

For more detail please see Import Payments

Importing loan applications on which disbursement has not yet been performed

When a new loan is imported, it is important for the system to have enough information for its further processing. Therefore, you can

Provide all necessary information during the import: The loan will be created in Origination or Underwriting status (subject to your business flow)

Provide part of the information: The loan will be created in Pre-Origination statua and will require additional details

For such loans, after customer and loan details have been imported, you can additionally import disbursements. (see Import Disbursements Batch )

Importing Dictionaries

...

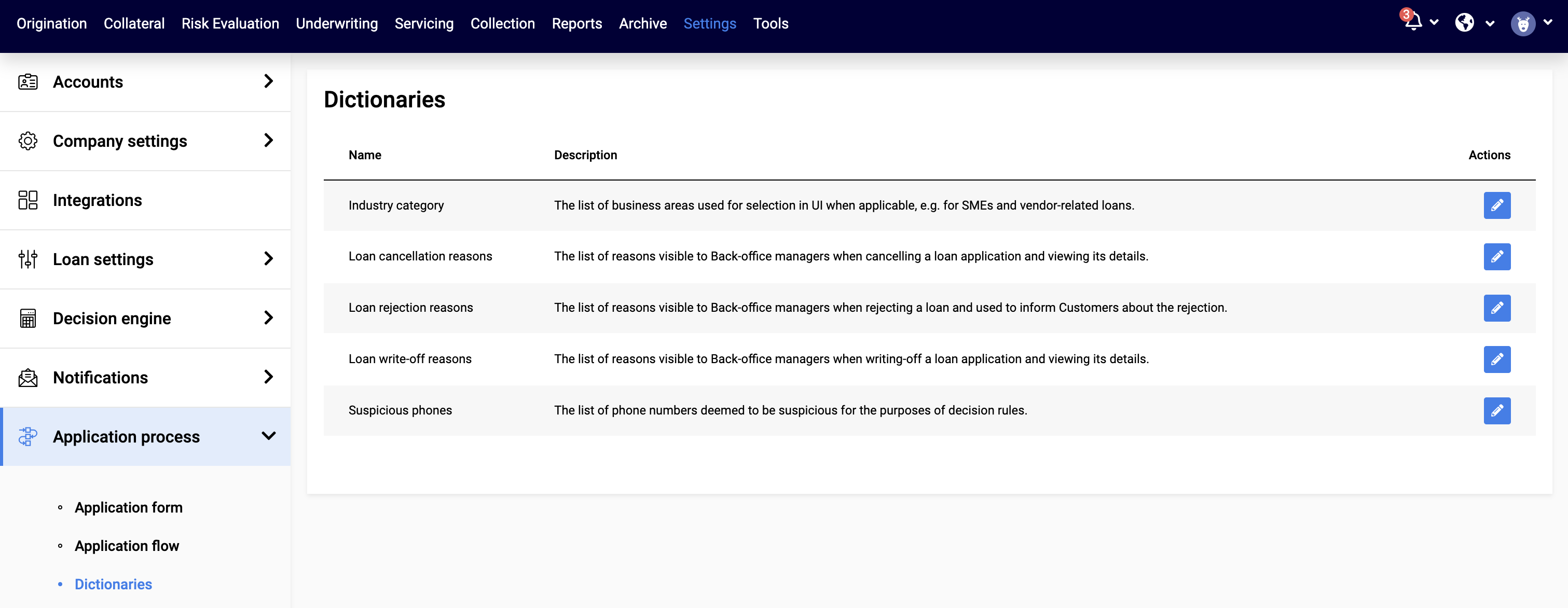

Write-off reasong, cancellation reasons, rejection reasons, suspicious phones and industry categories can also be imported via Excel files.

These are the same lists that can be defined from the Settings → Application process → Dictionaries.

| Child pages (Children Display) | ||

|---|---|---|

|

...

The rest of the fields depend on your company’s Application Form. If the application form foresees more mandatory fields and they have not been provided, the Customer is created with the status “Incomplete”. In particular, this will happen if the form requires any photos and documents - as photos and documents cannot be migrated via customer import.

Loan Batch Import

For a loan to be registered in the system, you must define:

Login: Login or email of the customer for whom the loan or loan application was created

Credit product: The credit product chosen for the loan or loan application

Value: The total amount lent

Periodicity: Installment period (monthly, weekly, etc.)

Other (optional) loan details are:

Interest rate: The interest rate defined for the selected credit product or specified in the final loan offer

Branch: Branch to which the loan is assigned

Start date: The first date in the schedule. When the funds are provided directly to the customer, it is usually the same as the disbursement date. However, when the funds are provided to a third party (e.g. a retailer who has provided services to the customer, the start date will be the date when the service has been provided, regardless of how the retailer and lender agree on the actual disbursement)

First due date: Date to which the first payment is due; end of the first installment

Equal payment: An equated monthly installment (EMI); a fixed payment amount made by a borrower to a lender at a specified date each calendar month.

Retailer and Shop: Retailer (AKA Vendor) and/or Shop that has received or is to receive the payment borrowed by the Customer (see Vendors and Stores (loan for a purchase) )

Sales tax:

Disbursement → Date: The date on which the loan funds have been disbursed

Disbursement → Reference number: Unique id of the disbursement used to refer to it in the system

Disbursement → Type: In general there are two types of disbursement called:

Automatic: in-the-system disbursement, initiated from inside the system and performed via a payment service provider

Manual: out-of-the-system disbursement. Regardless of the name, it doesn’t have to be performed manually - it is any disbursement performed beyond our system (via an external payment provider, face-to-face, with any kind of financial interests and mutual set-offs, etc.)

Disbursement → Comment: Any free text comment

Loan Status

The loan status depends on the information in the optional field Disbursement Date:

If the Disbursement Date is left empty, the loan is created in the Origination status.

If the Disbursement Date is defined, the Loan is created in the Active status. After the payment information has been provided, the Loan may be moved to the Past Due status.

Credit Lines

When a credit line is added to the system, the Disbursement information shall be left empty. It can then be registered in the system with the Disbursement Batch Import.

Disbursement Batch Import

...

Amount: Amount disbursed

Comment: Comment on the disbursement. If the optional “Disbursement → Comment” field has been defined for the corresponding loan, the reference defined in the disbursement must be the same.

Credit Lines

As none of the disbursement details have been provided during the Loan Batch Import for credit lines, you can create multiple disbursements for them using the Disbursement Batch import.

...