Interest Suppression in TurnKey Lender

Business Objective

In case when Borrower has temporary problems with payments by the Loan, he can request, do not accrue any amount (like Interest, Past Due Interest, Late Fee, any additional fees), except the Principal amount for a predetermined period in the future.Turnkey Lender System allows using the 'Interest Suppression' functionality for those Loans when only the Principal Amount will be accrued.

- Interest Suppression period can be added by Back-office User.

- Back-office User can manually set up a period (from 1 day up to 90 days) in the future when all charges except Principal will be suppressed.

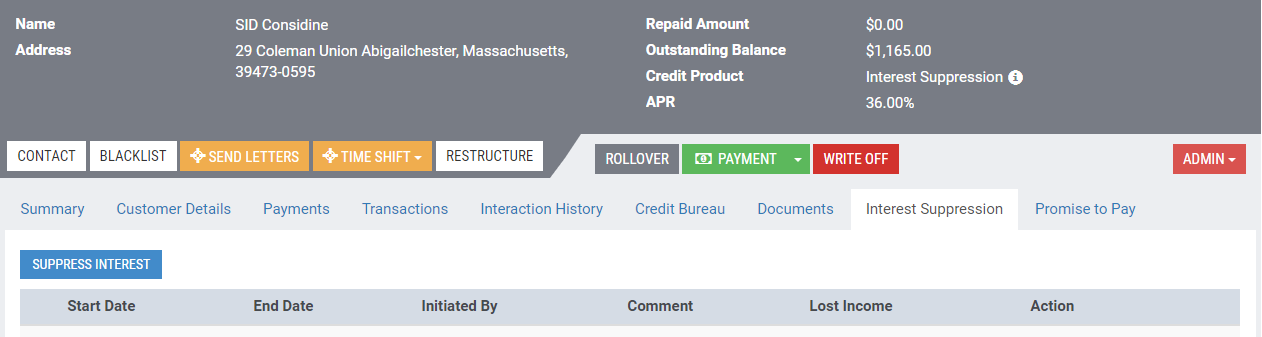

Interest Suppression Tab displays on the Loan Information Panel of the next Workplaces

- Servicing, if the credit status is Active or Past Due

- Collection, if the credit status is Past due

- Archive, if the credit status is Written off or RePaid (Viewing only)

Interest Suppression functionality works only for Credit products with enabled Early Payments

Add Interest Suppression period

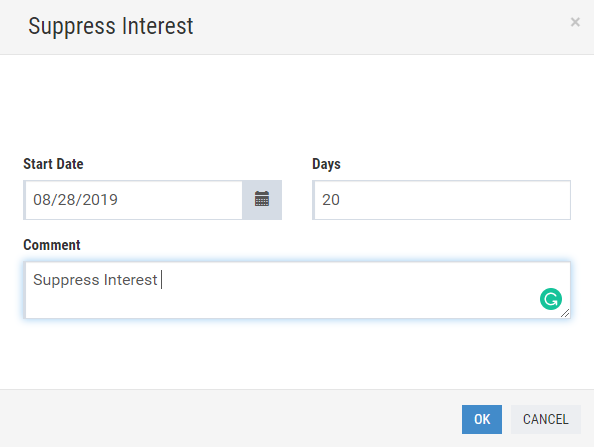

1. In order to add a new Iinterest Suppression period, navigate to Servicing or Collection workplaces, click on Interest Suppression Tub, click on Suppress Interest button on the Loan details area.

2. Once the button is clicked, Suppress Interest window opens.

|

3. Click OK.

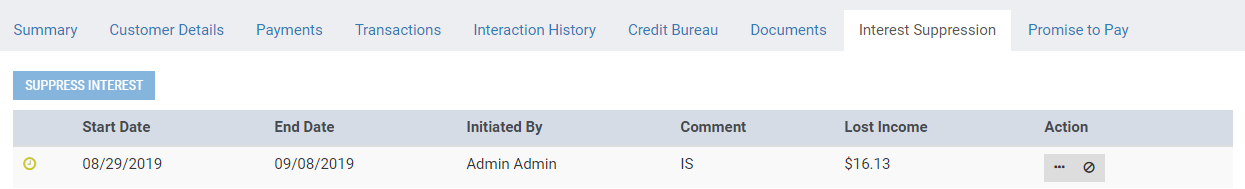

Interest Suppression Tub

Displaying Interest suppression Tab

- Start Date, is the date when the Interest suppression period starts

- End Date, is the date when interest suppression period will be expired

- Initiated By, is Back-Office User's information who initiated the Interest Suppression period

- Comment, is Comment left by Back-Office User when he creates interest suppression period

- Lost Income, is the amount that the Lending company loses during the Interest Suppression period.

Interest Suppression Status description

| Icon | Status - description |

|---|---|

| Active - The current date is more or equal Start Date and less or equal than Loan End Date | |

Pre-active - Interest Suppression period is added, but the Current date less than the Start date | |

| Closed - The End Date is equal or less than the Current date | |

| Canceled - Interest Suppression period was Active and canceled by Back-Office User |

Interest Suppression Action

| Button | Description |

|---|---|

Cancel button - The Back-office User can Cancel Interest Suppression period if this period has not started yet or is active. | |

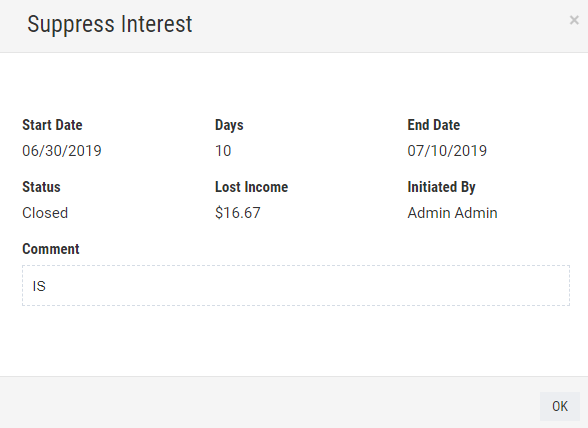

| Details button - Once the button is clicked, the Suppress Interest Details window opens. |

In order to Cancel the Interest Suppression period, Back-office User should have minimum two system Roles - Administration and Loan Manager / Collector Roles

If the Interest Suppression period was in the active state, for example, for 5 days after Start Date and Back-Office User canceled it - Interest and all fees are accrued for these 5 days.

Displaying Suppress Interest Details/history

Suppress Interest window displays details for all applied Interest Suppression periods for the current Loan.