Loan Restructuring

This subsection provides instructions on how to restructure a loan.

Turnkey Lender provides for restructuring a borrower's loan, i.e. changing basic credit terms for the borrower to repay a remaining debt amount. Restructuring can be applied to avoid the involvement of external collectors in case the borrower cannot repay the loan under initial credit terms.

The most common type of restructuring consists in loan extension aimed at reducing a monthly loan payment to an amount that can be repaid by the borrower. The less common case is when a loan interest rate or other credit product characteristics are changed.

In case of loan extension, a monthly payment is reduced, however a total amount of interest payments increases due to a longer credit term. Hence a total amount of payments for a restructured loan increases.

The main purpose of restructuring is to reduce monthly payments which can be achieved by changing a credit product, loan amount and term.

The Loan Manager can restructure loans with the following statutes:

Active;

Past Due.

To restructure a loan:

1) Above the table displaying the list of loan applications, click the All split button to apply the filter and display necessary loan applications.

Note: | Only "Active" and "Late" applications can be restructured. |

Loan applications are displayed according to the filter applied.

2) In the table, click a corresponding loan application.

3) Click the Restructure button.

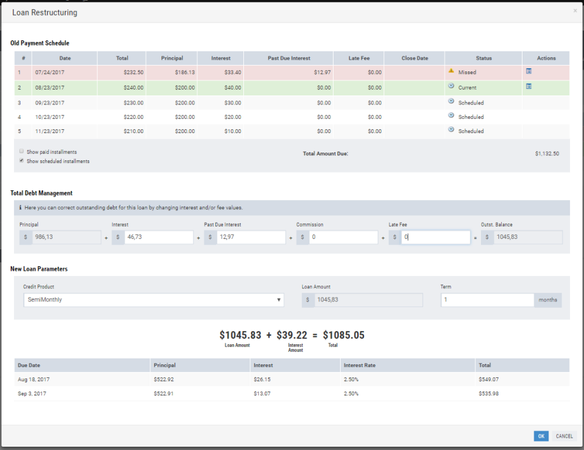

The Loan Restructuring window opens:

The Old Payment Schedule area displays information on a current loan to be restructured.

4) (Optional) In the Old Payment Schedule area, click Show paid installments to view all payment transactions.

5) (Optional) In the Old Payment Schedule area, click Show scheduled installments to view a current payment schedule.

6) In the Total Debt Management area, change the following data to change the outstanding balance:

Interest;

Past due interest (for overdue loans);

Commission;

Late fee (for overdue loans).

A change in the amount of interest and commission brings about a change in the outstanding balance and loan amount accordingly.

7) In the New Loan Parameters area, determine terms of a new (restructured) loan:

a. In the Credit Product box, select a corresponding credit product.

b. In the Term box, change a credit period.

8) In the Loan Restructuring window, click OK to complete the procedure.

The confirmation message opens:

9) Click Yes to confirm the operation.

The message confirming the successful operation is displayed:

A selected loan has been restructured and a new public ID is created for the restructured loan: R1 is joined to an old public ID by a hyphen, for example: EL-1829-R1. If the loan is restructured repeatedly, R1 is replaced with R2 and so forth. Once the loan has been restructured, the additional Restructuring tab is displayed in the loan application details area. For more information on this tab, refer to the description in the Servicing subsection above.