Decision Engine

This subsection provides instructions on how to set decision rules.

During the application processing, the system checks borrower's data under predetermined decision rules. The borrower's data are checked by the system in following cases:

when a loan application is first submitted for consideration from the Origination workplace to the Underwriting workplace;

after the loan application has been reworked by the Originator and submitted to the Underwriter for reconsideration;

after the loan application has been created by the borrower online and submitted for further consideration.

To set decision rules:

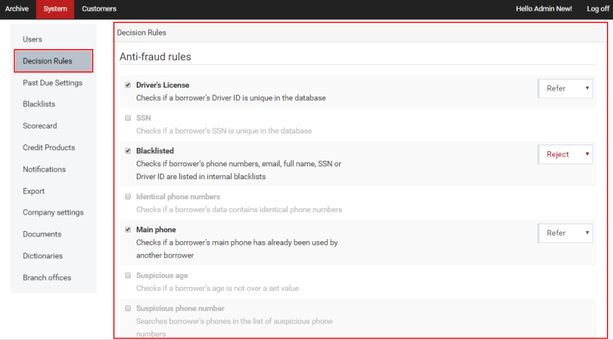

1) In the option menu to the left, click Decision Rules.

The Decision Rules area opens:

The Decision Rules area displays four groups of decision rules:

Anti-fraud rules;

Credit policy rules;

Internal rules;

Credit bureau rules;

Alternative rules.

All alternative rules are applied only for checking new borrowers who fill out a loan application from their personal account for the first time. When existing borrowers submit other loan applications, alternative rules are not applied. If existing loan application data is edited/modified, alternative rules are not applied either. This also concerns attached documents. However, alternative rules apply only to documents that have been uploaded by the borrower when creating a personal account and submitting the first loan application.

Each of the above listed groups has a number of rules according to which the borrower is checked by the system.

2) Add the check mark opposite decision rules that will be applied for checking the borrower's data.

3) Specify additional information (e.g. a maximum age, maximum number of defaults, etc.) if it is required for selected decision rules.

4) Specify a system decision for each selected decision rule:

Refer: the system cannot make a definite decision on the loan application, additional processing is required by the Underwriter;

Reject: the system recommends making a negative decision on the loan application;

Do nothing: the decision is informational and does not influence a scorecard decision.

A decision selected will be applied in case a rule has matched (if the borrower's data fall under a specified rule).

The final system decision as the result of checks under all decision rules is generated on the basis of the worst decision made. For example, if as a result of checks, one decision rule has the "reject" system decision and the rest decision rules have the "refer" system decision, the final system decision as a result of checks under all decision rules will be "reject".

If a selected rule has not matched (i.e. the borrower's data do not fall under a specified rule), the system will automatically make the "approve" decision on that rule. If each rule has the "approve" system decision, the system final decision as a result of checks under all decision rules will be "approve".

Note: | The final system decision on the loan application is based on the results of checks under the decision rules and on scoring results. If scoring and checks under the decision rules have resulted in the "approve" system decisions, the loan application will be automatically approved. |

5) Click Save Changes to complete.

The decision rules have been successfully set.