Types of Fees You Can Use in TurnKey Lender and Their Description

Glossary

| Term | Description | Periodicity |

|---|---|---|

| Administration fee | The administration fee is applied to each loan installment to cover loan administration costs. | Each installment |

| Disbursement fee | A disbursement fee can be added to a credit product as a fixed amount or a percentage of the loan amount. All disbursement fees are deducted from the loan amount upon disbursement and the rest is transferred to a borrower manually or via an integration with a payment provider. The loan schedule is based on the initial Loan Amount. | Disbursement fees are applied and immediately paid as soon as a loan is disbursed, regardless of their priority in the fees list. |

| Down payment | The Down payment amount is a charge that represents a part of the full purchase price/loan amount. It is paid by the borrower and deducted from the loan amount after the loan is approved. | One-time fees, when payment transaction is done by Customer before disbursement |

| Late fee | Some types of loan products accrue penalties for late payments. The penalty is charged once a payment is delayed by a number of days specified in the agreement (Installment past due). There may be several agreed upon numbers of delay days, and for each of them, different amounts of the fine may be charged. There are two ways of calculating the fine: 1) the contract defines the absolute amount of fines (Absolute Fee) for each of the days of delay, regardless of the amount of the current debt; 2) interest rates are determined in the agreement, indicating the method of calculating interest for delay. Depending on the chosen method of calculating interest for delays, penalties are charged for each of the days of the delay. | DPD - the number of days past due when the fee must be applied to an upcoming loan installment. |

| NSF | Non-sufficient funds (NSF) is the term used when the checking account is overdrawn — meaning there is not enough money in the account to pay the check written against it. The bank (payment provider) returns the “bounced” check to the accountholder and charges a returned-check charge, or a NSF fee. A returned check stamped with NSF means that the check wasn't honored by the bank because the accountholder doesn’t have enough funds in the account or the account has been closed. In this case, the System will apply an NSF fee on the loan in an amount predefined in the Credit Product settings. NSF charges apply once a monthly payment from a borrower does not go through. | NSF fees are included into Commissions, and are paid according to the general Payment Order rules |

| Origination fee | Regardless of the payment schedule calculation method, Origination Fee adds to the first installment (i.e. it is a part of the first scheduled payment). Origination Fee is calculated based on one of the following parameters set in the Credit Product:

| One-time fees applied to loans to cover for the price of origination. |

| Past due interest | Interest for late payments is accrued in the system depending on the Past Due Interest setting in the Credit Product. It can be based on the current total debt on a loan (Outstanding Balance) on the current payment (Current Debt), only on the body of the loan (Outstanding Principal), or on the current outstanding debt on the body of the loan (Past Due Principal Debt). Penalties may be applied to late payments by changing the settings of the Credit Product's Late Fees, according to which additional interest will also be charged with similar methods of calculating interest for late payments. The main idea of calculating interest on arrears is as follows: the interest on arrears is calculated daily as a percentage of the current amount owed. The percentage is set by the Overdue Interest Rate in the Credit Product, and the amount owed is determined by Overdue Interest Type parameter. | Daily fees applied to a loan in case an installment isn't paid on schedule. |

| Payoff fee | A Payoff fee can be added to a Credit Product as a fixed amount or a percentage of the repayment amount. Once a repayment transaction with 'Payoff' type is created, a calculated payoff fee is accrued and paid first. Payoff fee is a sum of all fees that are assigned an Event Type 'On payoff' in the Credit Product. | One-time fees applied when the loan is paid off ahead of schedule. |

| Pre-approval fee | A fee to be paid by a customer for a new loan before the application will be sent for approval. | One-time fees applied to loans (Before approval) |

| Pre-disbursement fee | A special kind of initial payment. It's a fee to be paid by a customer for an approved loan to allow disbursement. | One-time fees applied to loans that should be paid while the loan has a status 'Pending initial payments'. If the payment isn't made, the loan gets expired. |

| Repayment fee | A repayment fee can be added to a Credit Product as a fixed amount or a percentage of the repayment transaction amount. Once a repayment transaction is applied, a calculated repayment fee amount is deducted from the transaction amount. The rest is applied according to the general rules. Repayment fee is a sum of all fees that are assigned an Event Type 'On payment' in the Credit Product. | For each payment transaction |

| Rollover interest fee | The Rollover interest fee is an additional charge applied once when rollover is created. | Once, when a rollover is applied |

| Sales tax | Sales tax can only be specified as a percentage and can be set as a constant value or with fee ranges. Sales Tax = Paid Principal * Sales tax % rate. | For each payment transaction |

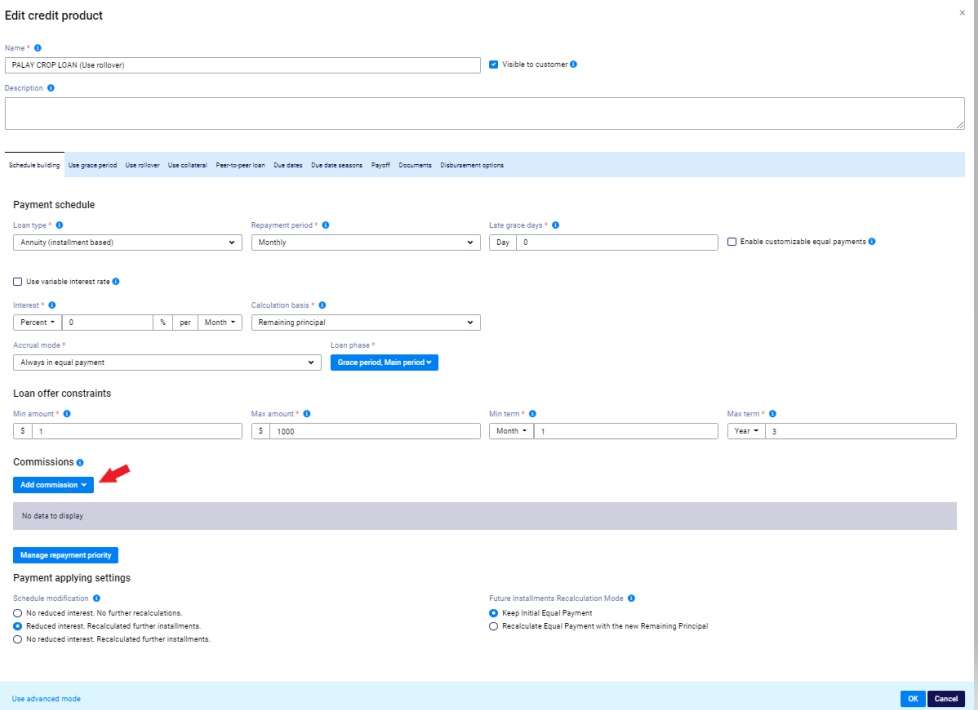

Applying fees to Credit Products

In the Credit Product settings you can define commissions and fees to be automatically accrued to the loan applications that use this credit product.

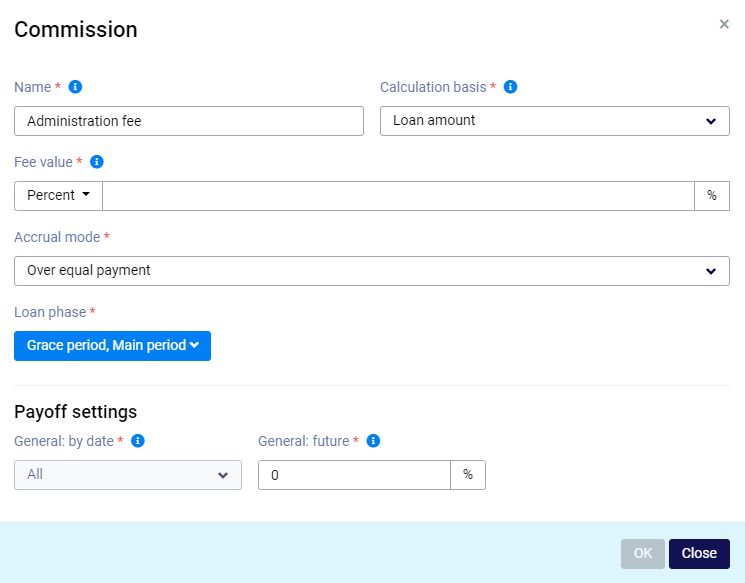

| Field name | Parameters | Description |

|---|---|---|

| Name | Administration fee | Full fee's name |

| Calculation basis |

| |

| Fee value |

| This value is used as the Commission Rate for all loans created using this Credit Product |

| Accrual mode |

| |

| Loan phase |

| |

Payoff settings General: by date |

| Accrued, but unpaid amount by the current date is included in Pay off amount |

Payoff settings General: future |

| Future scheduled amount is included in Pay off amount |