Release 7.4 (29 December 2020)

Making Retail Finance & Digital Lending Even Easier: New Major Features & Updates for Smooth Digital Crediting in 2021

To start-off 2021 on a positive note, TurnKey Lender is happy to announce the final release in 2020. V.7.4 includes major upgrades to the existing features as well as brand-new functionality revolving around the needs of professional lenders and retailers willing to offer financing to their clients in-house. And we'll be starting with features any lender can benefit from, no matter the vertical they work in.

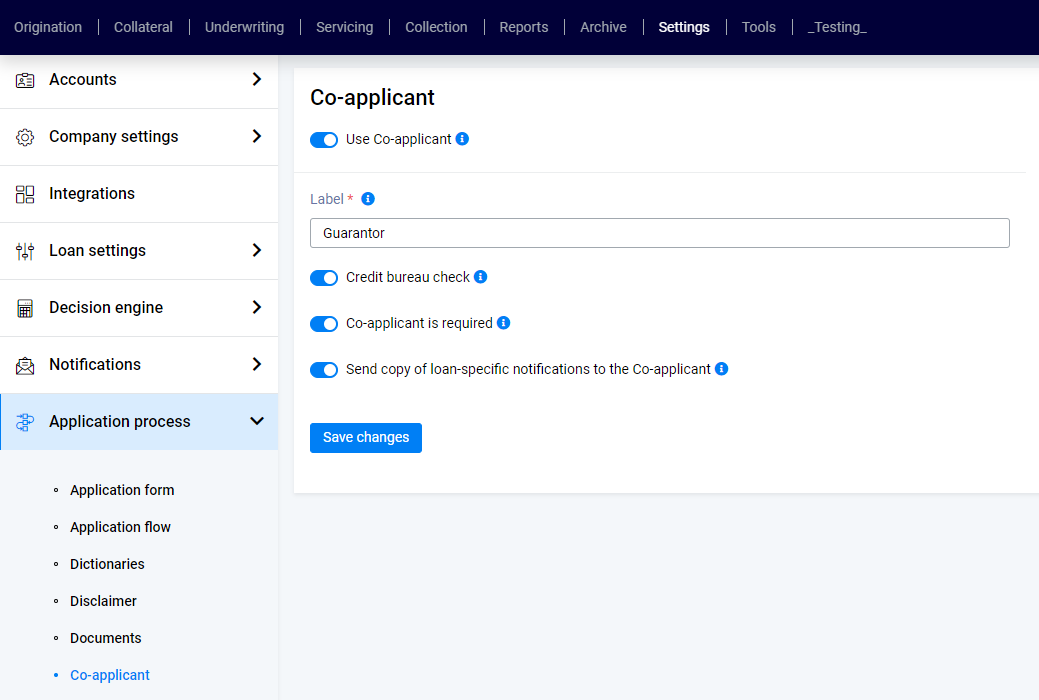

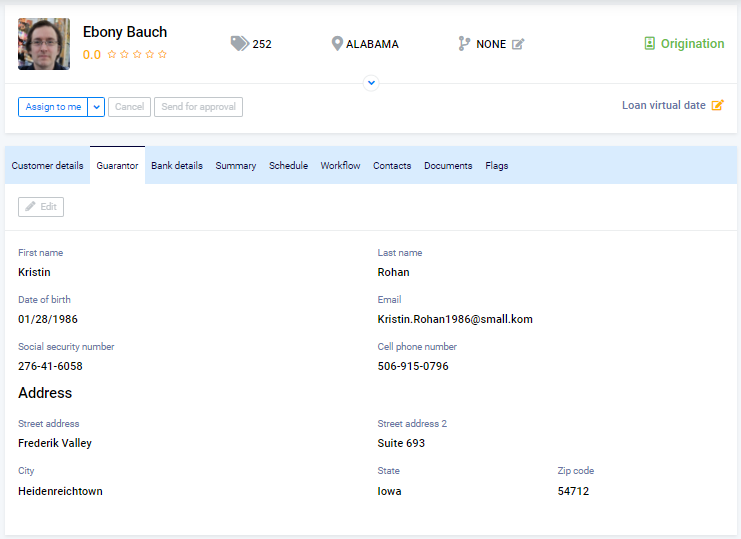

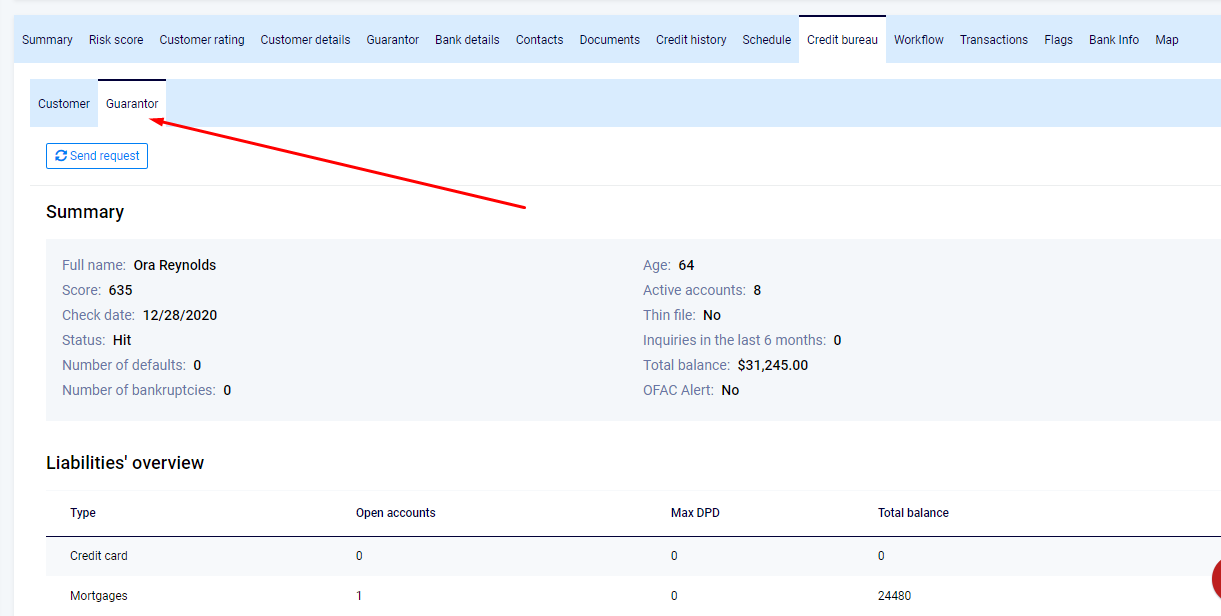

Fully-fledged work with loan co-applicants built-in

Starting with v7.4, lenders can now enable co-applying for loans with a simple switch in the Application process settings of their TurnKey Lender platform.

With customers being able to add co-applicants to their loans, digital lending becomes more secure. If that's the case, on the application form, a borrower can add a co-applicant (can be renamed on UI, for example, spouse, guarantor, co-signer, co-applicant, etc) who will act as an added risk-reducing factor for the lender. If this feature is enabled, a block with co-applicants personal details is automatically added to the loan application.

Co-applicant can be scored in your System as a customer, or not - you control the settings. The co-applicant is assigned to each specific loan and receives notifications about being added to a loan, about disbursement, and pay-out. The system flexibility allows Back-office users to change all the Co-applicant's settings (whether or not it's required, name on UI, notifications' text). Also, a Co-applicant appraisal has been added to the Decision Engine.

Loan offer for intelligent pre-approval

In v.7.4 we've taken loan pre-approval and loan terms editing freedom to a whole new level. If enabled, pre-approval (conditional approval, indicative approval, or approval in principle) is a quick (often automated) step in the loan application process allowing you to quickly provide preliminary terms that you are willing to offer to each particular borrower in a matter of seconds. If they accept the terms set by your staff or our AI configured to your criteria, you can proceed with documents processing, in-depth analytics, credit bureau hard checks, etc.

Soft checks don’t harm the credit history of the borrower and allow you to work with a much larger client base. They are often used on the pre-approval stage as an excellent marketing and business development tool. Gain a competitive edge both in terms of customer experience and risk scoring by at first doing a soft check and then, as soon as the client accepts the terms, perform a hard check for KYC and AML compliance.

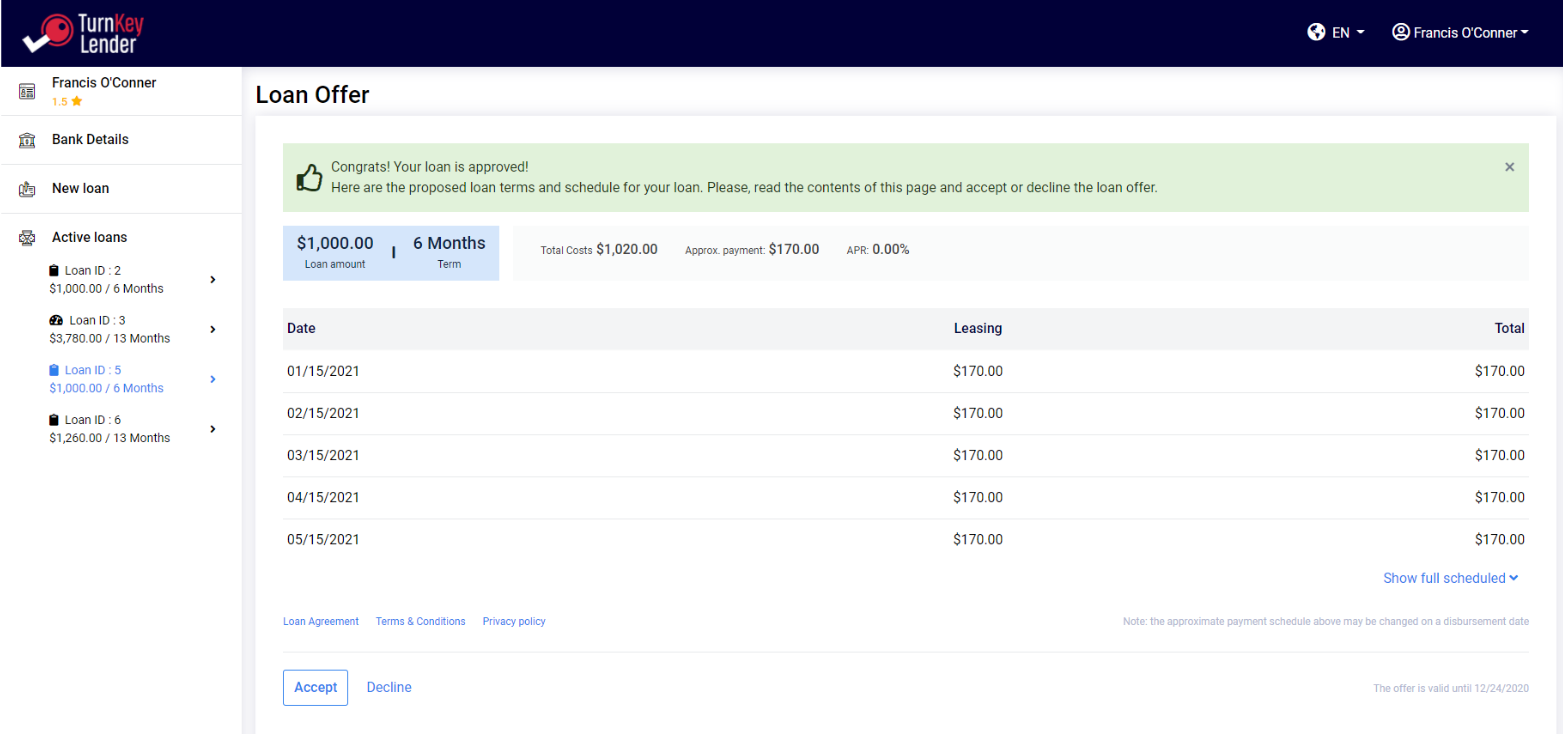

Сhange loan terms and send out a loan offer

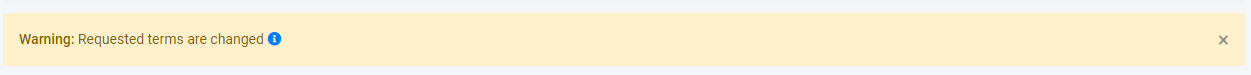

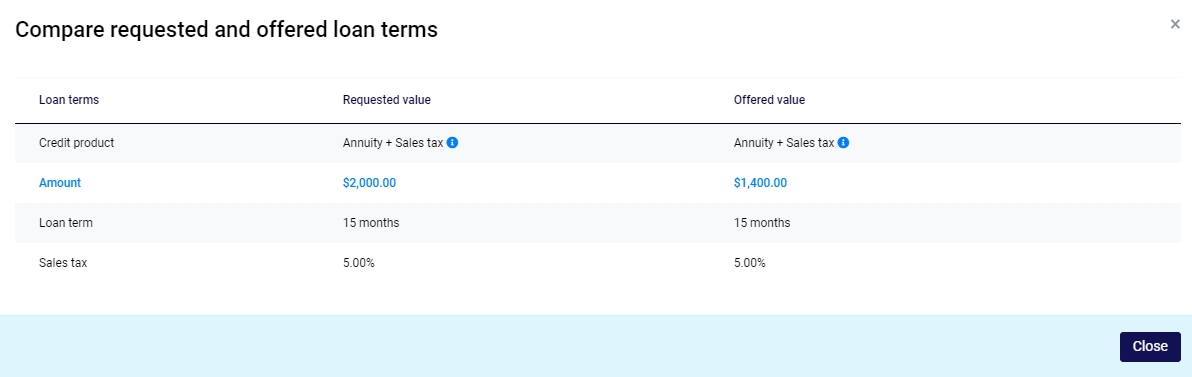

When a new loan application lands in your TurnKey Lender platform, underwriters and originators can tweak every detail of the loan terms requested by the borrower with a click of a button as well as see all the information of each application at a glance.

Use case: The client requested $3000, but based on their creditworthiness we are only prepared to give them $2300 at a higher interest. In such a case, the borrower must explicitly confirm new loan conditions before the loan can be disbursed. The underwriter updates loan terms in the application and as soon as the loan is approved, we automatically send the offered loan terms to the borrower. The client reviews the loan offer details and schedule. If the client accepts the terms in their Borrower portal, they receive the loan agreement and, once signed, the loan is automatically disbursed.

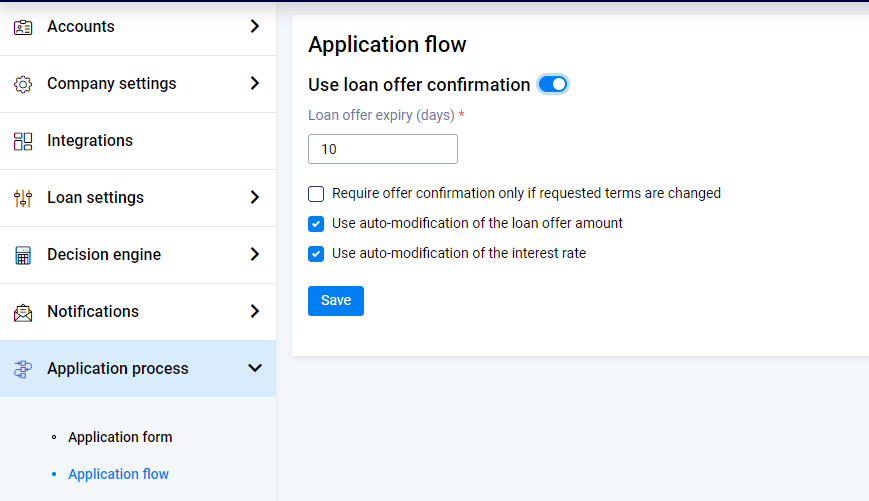

Setting custom expiry dates

To avoid the situation when the loan application is stuck waiting for the loan offer confirmation by the borrower indefinitely, the loan is automatically closed after a certain period of time, and a set of reminders sent to the borrower.

To choose for how long your loan offers stand, navigate to Settings → Application Flow. You can also choose whether you’d like to send loan offers to all clients before the loan agreement. Or we can only send it to the clients whose loan terms have changed.

Automatic loan terms changes on the fly

TurnKey Lender can now automatically adjust loan offer details with help of custom unique credit decision rules you select. Based on the client’s Creditworthiness, you can automatically reduce the loan amount for risky clients or on the contrary provide better terms to exemplary clients.

What's even better, you can combine loan offer terms changes with the Downpayment functionality described below. So if a product costs $2000 and you’re only willing to finance $1500, the client will have to pay the difference to you upfront to get the product.

The system changes the loan terms automatically based on the borrower’s Creditworthiness (an AI-fueled metric calculated on the basis of all scoring factors).

You can even provide us with a formula of how you’d like our AI to change the loan terms and based on what indicators. We do our magic and voila, the System works. Your underwriters can just control it and finetune it when the need in the market or product line arises.

System improvements created specifically for retailers

The first iterations of TurnKey Lender Retail are gaining more and more traction around the globe and specifically in North America. The enthusiastic reaction to the Retail solution we've launched helped our team gather new valuable insights about the features that will simplify the day-to-day of a retailer and will allow them to run a fully-automated digital lending operation that suits the exact needs of the business model retailed pursues. Here are the most important upgrades retailers can use in TurnKey Lender v.7.4

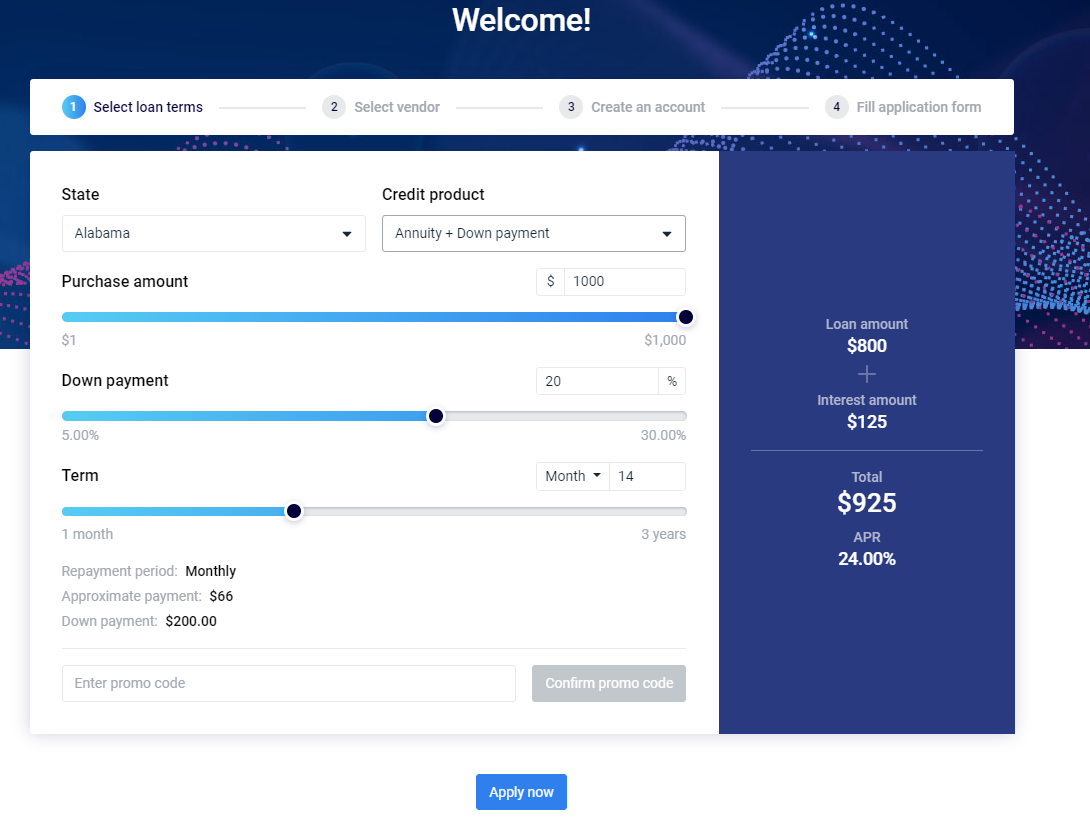

Downpayment & Pre-disbursement fees

As lending gets more and more digital, downpayment gains traction as an effective measure to reduce the loan non-repayment and fraud risks. Retailers, manufacturers, equipment, and service providers need an additional layer of protection and security when it comes to digital lending. That is why by a popular request, TurnKey Lender now has extended functionality to charge configurable down payment and/or pre-disbursement fees on autopilot.

Down payments are an important part for businesses working in retail, real estate, renovation, medical services & equipment, manufacturing, furniture, auto dealerships, and many other businesses.

For the borrower, the availability of a downpayment reduces the loan body, simplifies loan approval and decisioning, and allows the client to get their product or service at once.

For the lender, downpayments are often a preferable model that reduces credit risk and makes the lending process more streamlined allowing for a quicker repayment and less paperwork than, for example, working with collateral assets.

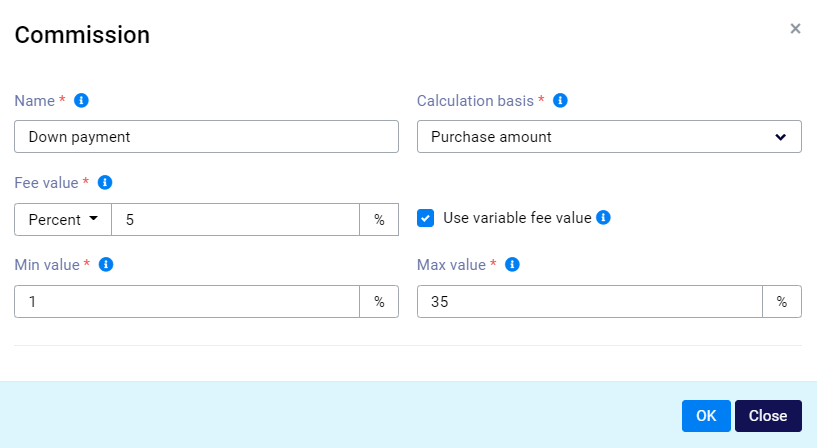

With TurnKey Lender v7.4, you can charge both a set percentage of the loan as downpayment, a specific fee, or a fee in a range that works for you which you can all set in an easy-to-use credit product constructor.

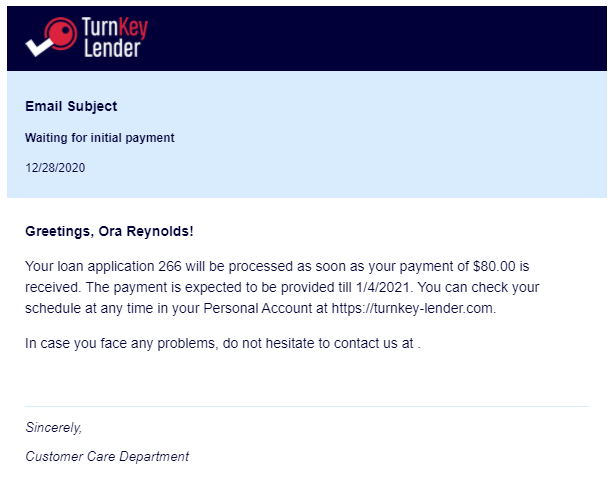

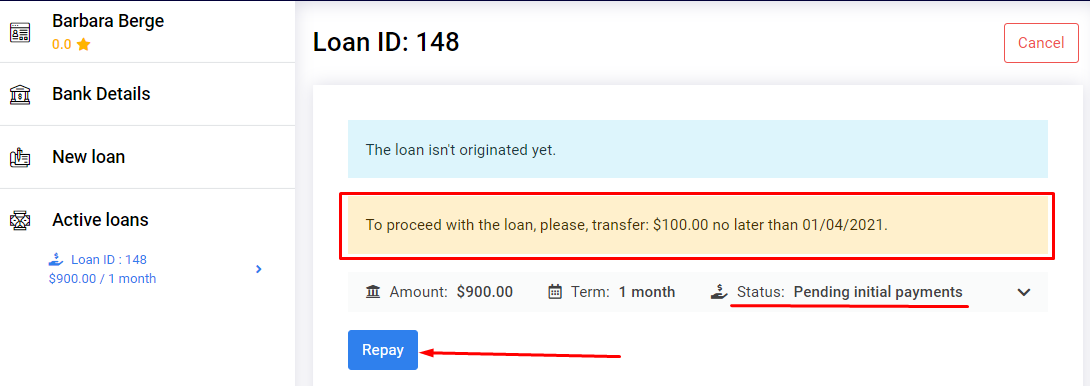

To ensure added security and fraud prevention, downpayment and fees can be charged before the disbursement. The client will be notified that they need to make the initial payment before they can proceed with their approved loan.

API Client, that comes built-in with TurnKey Lender, allows you to integrate your store's front-end with our system directly to transfer info about financed loans to the warehouse for further order processing. TurnKey Lender can be integrated with your e-commerce of choice as a part of our professional services.

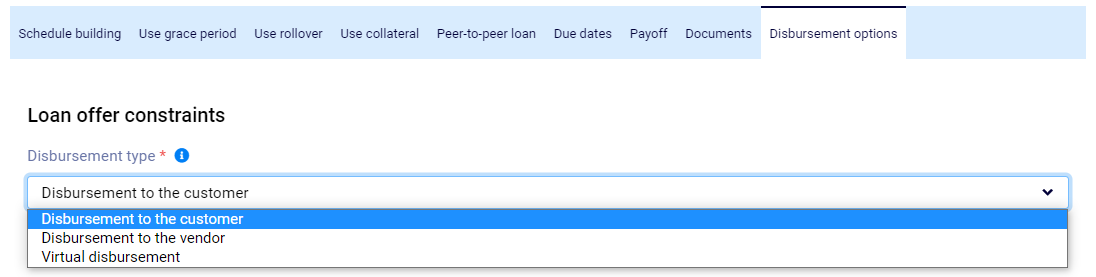

New disbursement models - credit product flexibility inaccessible to any and all of our competitors

Product and service providers don't always need to actually disburse funds to the client's account, rather they just provide the product once the loan is approved and the downpayment paid. The choice to use TurnKey Lender for in-house consumer finance is easier than ever with these 2 new disbursement models available to clients in v7.4:

- The product or service provider acts as the lender - As soon as the downpayment is received, TurnKey Lender communicates that you can provide your product to the client. In this model, the embedded lender charges the downpayment to kickstart the virtual loan. The fact that you provided the product or service replaces loan disbursement. So your client can simply start loan repayment based on the agreed-upon schedule.

- You provide a lending platform for partner product/service providers - In this case, TurnKey Lender client provides a lending platform to their vendors/partners. The buyer purchases something from the vendor with a downpayment. The loan is then transferred to the lending platform which in turn transfers funds for the product or service to the vendor. The lender then takes care of collection with help of TurnKey Lender.

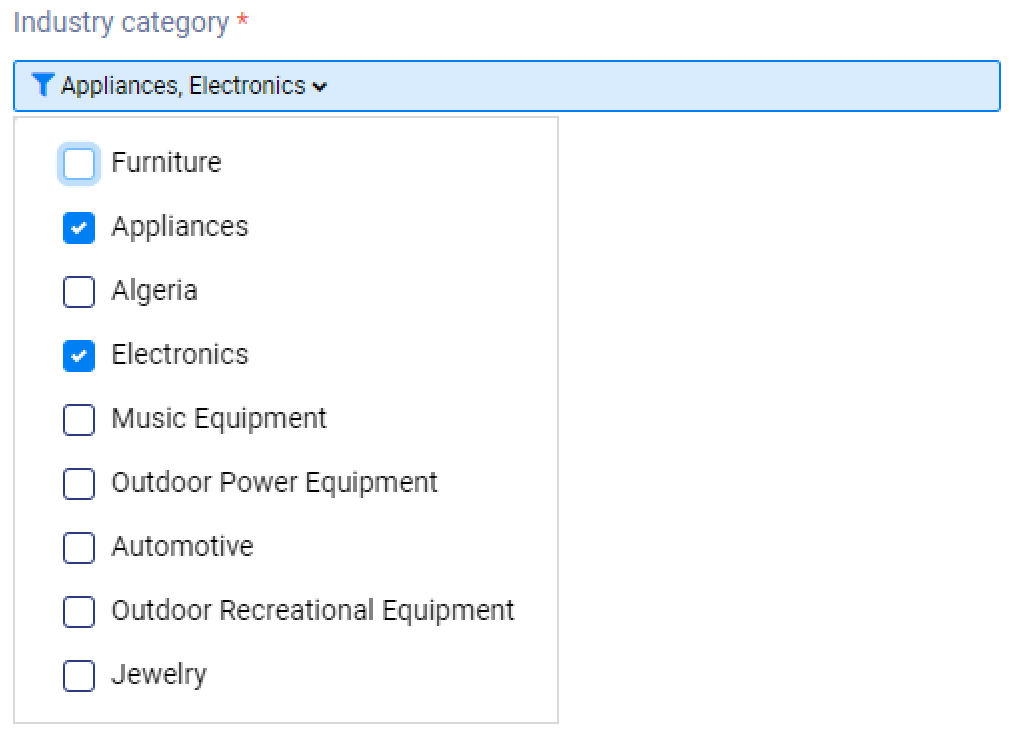

Many industries for your vendors to choose from

Now your vendors can work in multiple industries from a single account in your lending platform. One of the most common business scenarios, a vendor with many stores with different products and or services has a single master profile with users assigned to different stores, with different industries having access to credit products with specific terms. This allows for a more seamless experience for lender's clients, with vendors creating loans specific to the store’s settings and customers easily finding a needed merchant and store easier. This also results in a better-structured reporting and analytics.

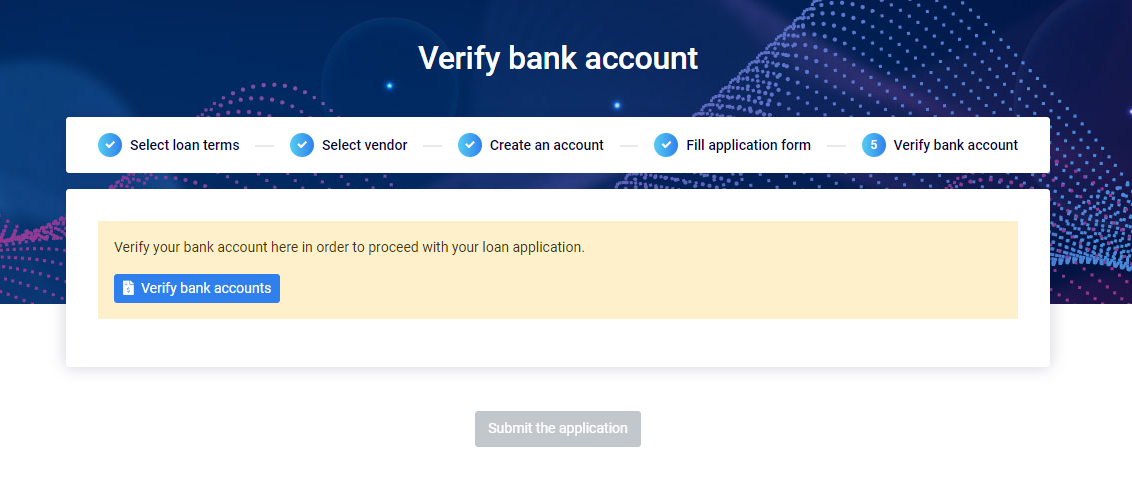

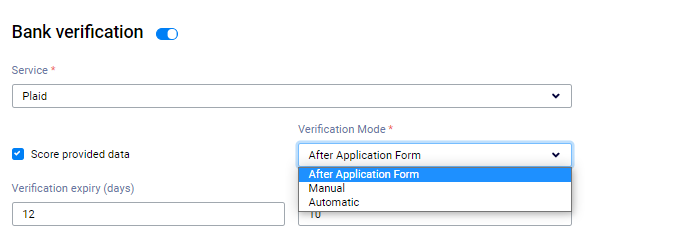

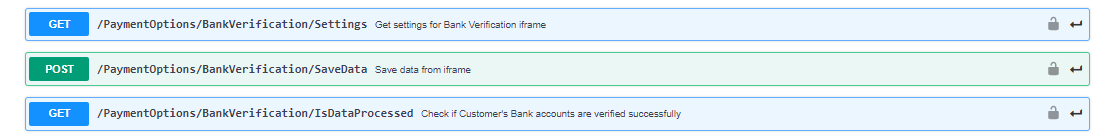

Verify and score bank statement data on any step of the application flow

Starting with v7.4, you have three choices for when to verify bank account details and score bank statement data:

- The bank account scoring is conducted on demand when an Underwriter presses a button. In this case, the borrower has to wait while underwriter analyzes their application. Then the borrower verifies bank account details in the Borrower portal. The plus side of this approach is that you cut costs on verifying the applications which would be filtered out in autoprocessing. For borrowers who have rejected loans in the past - this step always manual.

In the two new flows, the bank account verification is required on the loan application stage. This way, for the borrower it’s a single flow and you get all the bank statement data analytics to the underwriter at once, which makes it significantly easier and quicker to make a credit decision. And the client gets the entire application done in one sitting without having to return to share bank account details.

2. Verification is conducted on a new, optional, final application step, after the application form is filled out.

3. Automatic bank account verification is obligatory for all borrowers during the loan application.

Now Administrator can configure the bank account verification flow setting from the back-office, They chose when bank verification will be done and how it will be conducted.

Unmatched loan application form customization and integration freedom

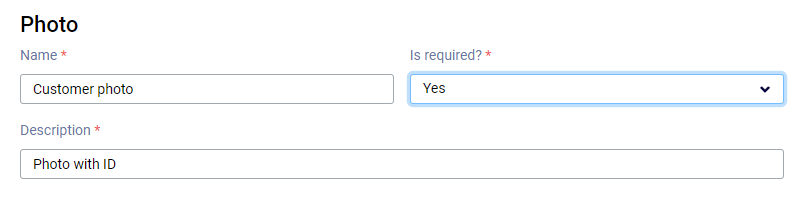

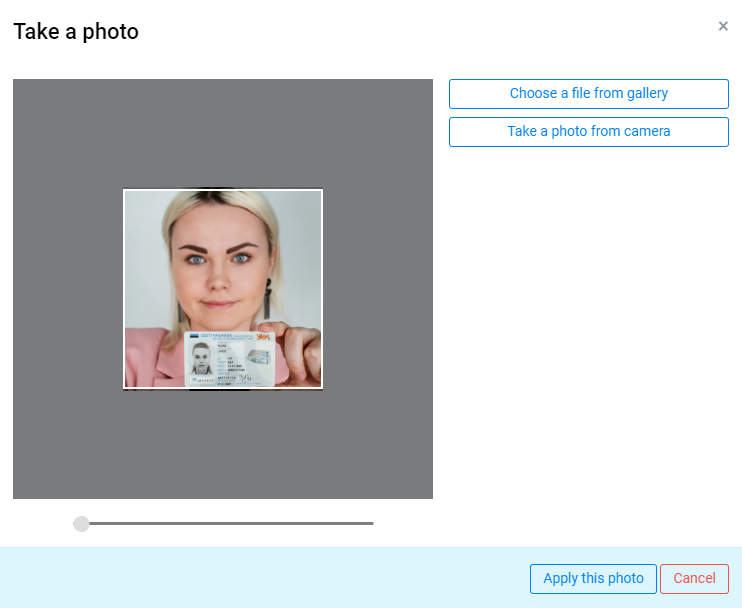

Borrower photo attachment

When creating a loan application, the borrower can take now a photo of themselves with the built-in camera of their device or the webcam. It is often required to attach a photo to the loan application (optionally you can request photos with a form of ID). This can now be taken care of instantly. You can even leave a comment next to the field, specifying the acceptable photo format.

Coming up in the next release!

We already have a working face and document recognition technology we can apply for our clients, and we’re working on implementing it into Box! The way it works is the borrower takes a photo of themselves and their ID, and our system will analyze and cross-reference the two.

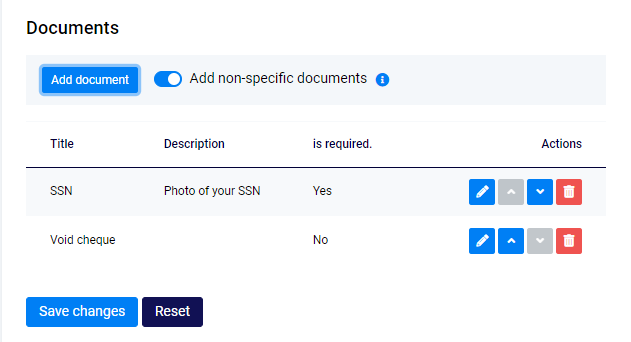

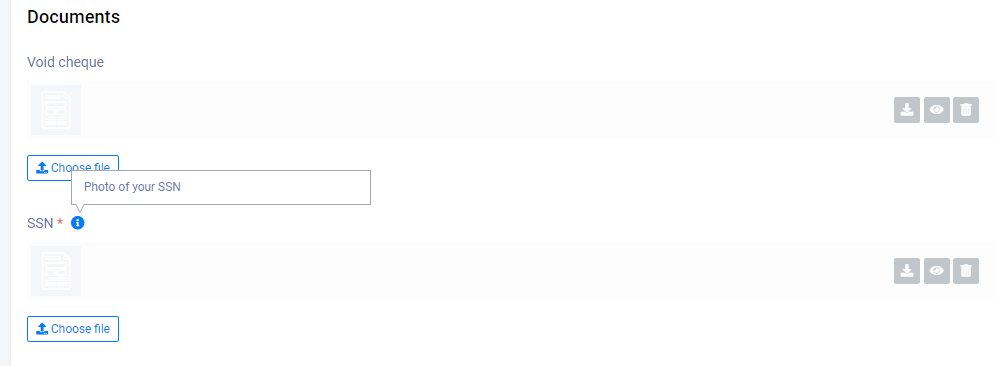

Custom documents list in the Application form

Back-office users with sufficient permissions can now select the documents the borrower will be required to attach to the loan application form. So when a borrower fills out the loan application they can upload the documents required by the lender, as well as additional files they deem relevant. The required document fields can be marked to identify, what file needs to be uploaded.

You can significantly reconfigure the loan application form and flow right from within the admin panel without the need to involve our developers.

Making such changes or implementing these features to any of the competing lending systems will cost you a small fortune.

Public TurnKey Lender API improvements

We continue to build robust tools that allow business owners to build their own innovative digital lending solutions relying on TurnKey Lender API technology.

Build a custom investor portal with TurnKey Lender API - Create and upgrade your Investor portal with TurnKey Lender API. Your company now can use all our industry-leading features and technology and apply them to your own front-end with branded company style, detailed preview all investment opportunities, custom creation and managing of bids, tracking payments and profit.

API-enabled aggregators - Connect our system to an aggregator or create your own - For lenders looking to create an Investment aggregator, our API has all the required functionality to run a fully operational peer-to-peer loan aggregator that integrates loans from different lenders and unites investors from all over the world.

Vendor Public API - allows meaningful integration of the Vendor management module into your operation and lets you collect and process all the necessary information about vendors and their stores.

New and improved integrations

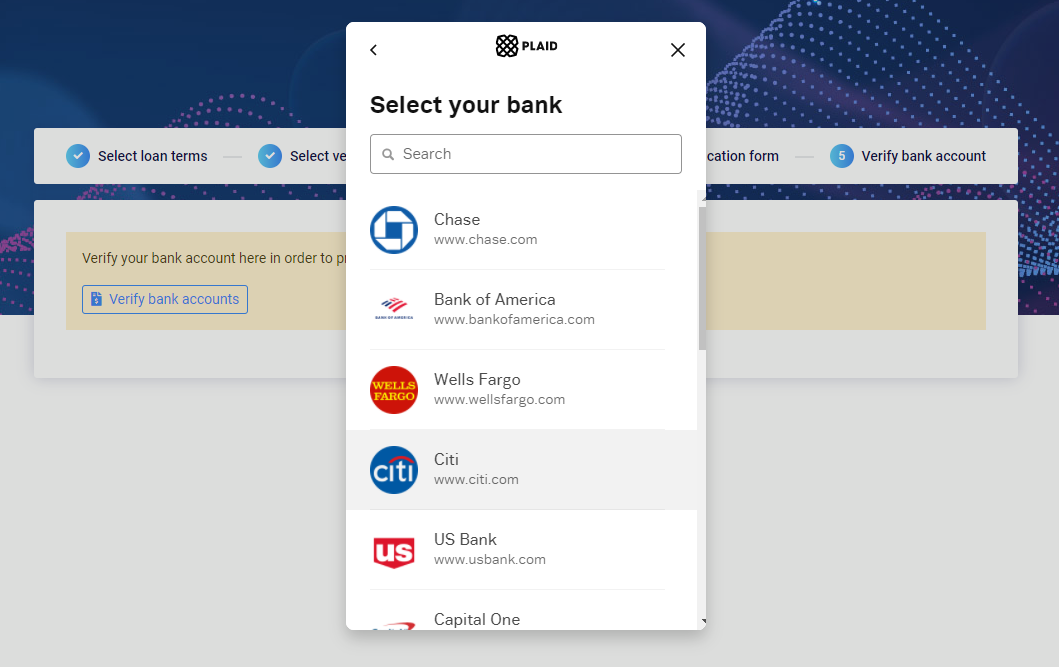

Plaid & Flinks

v7.4 marks the release of advanced Plaid and Flinks integrations to enable the freedom to create custom flows for one-click payments, autocharges, and more accurate credit decisions, as well as to securely access clean, categorized financial data.

Experian US

New, extended Experian integration provides us access to a ton of new data which we've used to create new decision rules to process and use it for better scoring and more accurate creditworthiness. Experian collects and aggregates information on over one billion people and businesses including 235 million individual U.S. consumers and more than 25 million U.S. businesses. TurnKey Lender integrates with Experian to pull and analyze extended data sets:

- Credit report & FICO Score

- Main Info / Raw report (full report from Experian)

- Specialized business rules

All results are integrated into the final Creditworthiness indicator together with all other score results and business rules.

System UI & UX design updates

Disable Welcome page

You can now disable the welcome page of your TurnKey Lender Platform in a matter of minutes in System configuration. This will be useful when the lender creates loans on the side of the existing CRM, lead generation platform, marketing site, or any other place where you’d like to collect data. You can then send this data to TurnKey Lender via API and the client can instantly login into their TurnKey Lender Borrower Portal to work with their loan without even realizing that they’re dealing with two digital entities, allowing for a seamless fully automatic experience.

System settings allow to quickly disable the Welcome page and New loan creation for borrowers so if your business process only includes new loans from Back-office or via API, TurnKey Lender team can easily switch on this function.

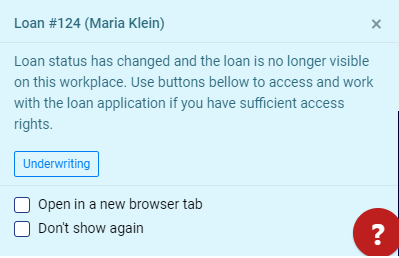

Save hundreds of hours managing loan applications

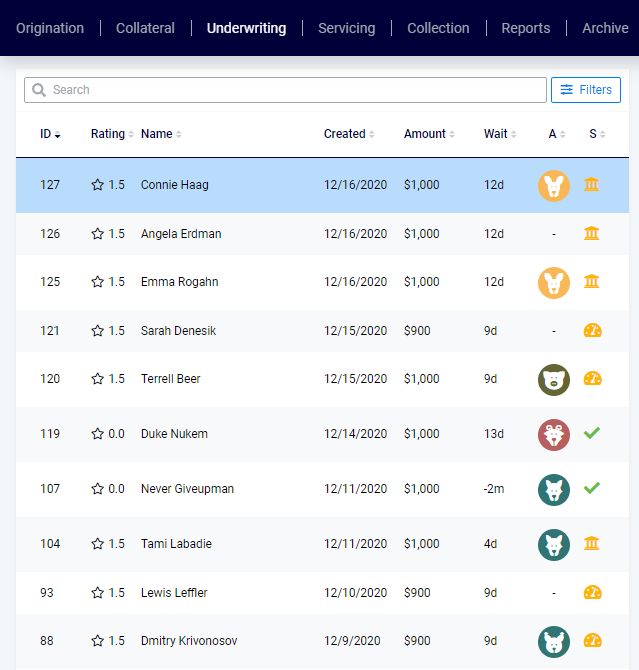

We've implemented new navigation functionality that allows even a mid-size lending operation to save hundreds of unproductive hours per year. Popup window that indicates where you can find a loan when a loan changes the workplace. Click a button and continue working with loan application in the new workplace (e.g Origination -> underwriting -> Servicing) instantly.

Each time you need to find a loan application that has changed its status, you spent at 5 seconds per action. A moderate estimate of 100 actions per day per one user, 10 employees → 10 hours per week → 520 hours per year.

Now you can find and access loan applications in a new workplace with just one click.

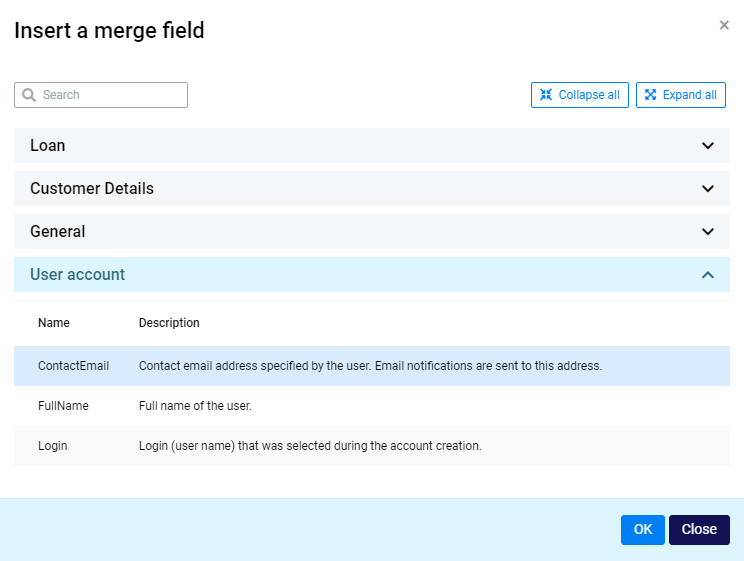

Efficient work with 200+ merge fields for the effective borrower and investor communication

Search 200+ of merge fields by name and description to save a ton of time creating beautiful custom email and SMS notifications and reminders when launching the system, creating new products, and promotions.

You don't need to learn to write merge fields or spend time looking for the right one in the documentation. Now back-office users can instantly find and use needed fields, as well as collapse-expand certain groups. Also, standard Collapse all and Expand all buttons are added.

More awesome features for a more streamlined lending experience

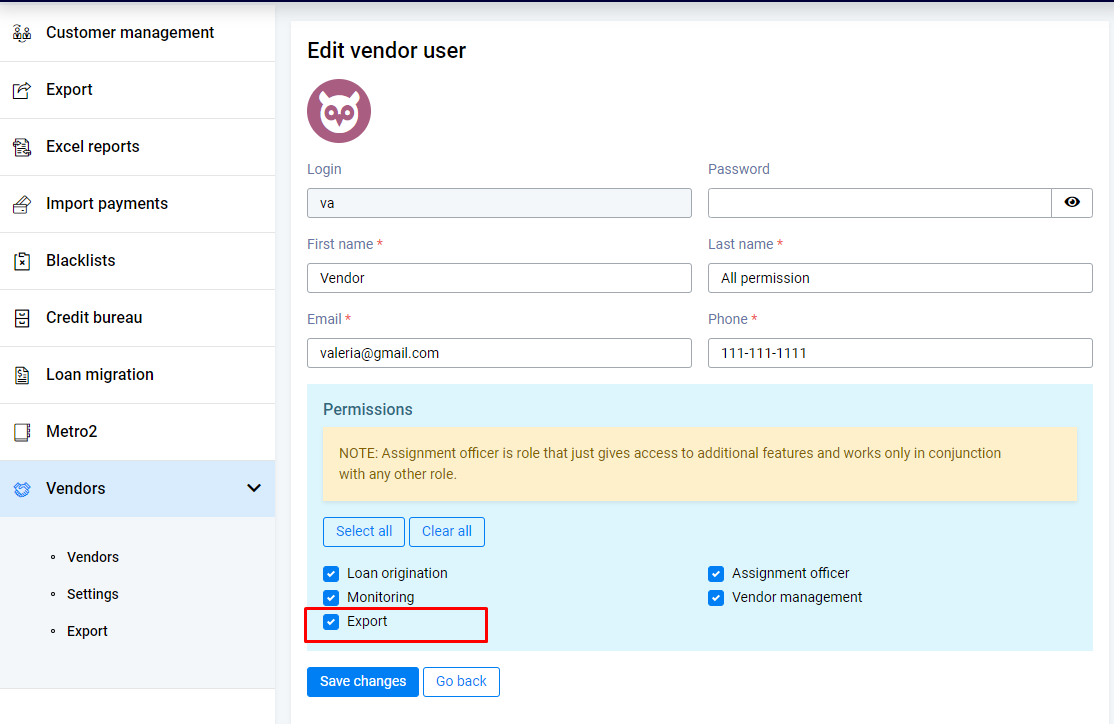

- Vendors get an Export workplace with permission-based access - Permission-based Export workplace Vendors who use the client's lending platform to only show exporting and business performance, and financial performance data to the right people within their organization.

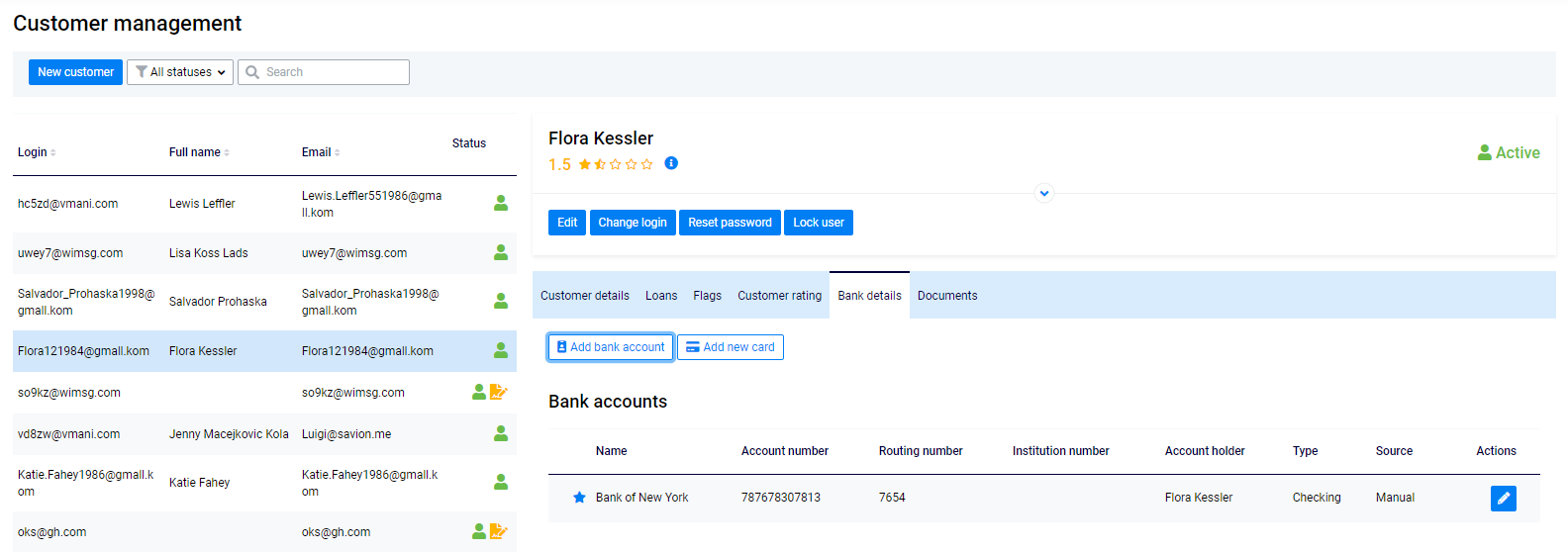

- Bank accounts and cards on the Customer management page - At any moment, a manager can find customer's bank info on the Customer management page. Easy and quick. No meter what statuses their loans have.

- Cute animals avatars - welcome the new system-generated default avatars for clients with a random selection of animal icons and colors. Initials in avatar are still an option, but we’ve added a new animal avatar pack. We can replace the animal pack with your own!

These are the last release notes our Product team is going to release this year, so we'd like to wish you and your loved ones happy holidays and for 2021 to be the year when you accomplish your most ambitious goals. And as always, our market-leading lending automation tools will be there to help you every step of the way.