Digital lenders are in a dire need for agile, reliable, accurate, and intelligent borrower evaluation approaches. And this is exactly the TurnKey Lender specialty.

Over the years we've automated lending operations and credit decisions in over 50 countries for lenders of all sizes and types. Observing the performance of our clients, we've noticed that even in the pre-corona economy it was a lot safer and more profitable to utilize both traditional and alternative borrower evaluation approaches. And now, as the 2020 crisis makes traditional credit scoring models obsolete, the demand for alternative approaches, like bank statements scoring, skyrockets.

TurnKey Lender Decision Engine comes preconfigured with an AI-powered scoring model and meticulously adjusted decision rules which can be fully customized by the client from a well-designed Dashboard. And today we'd like to present the Bank Account Verification and Bank Statements' Scoring in TurnKey Lender.

It's a set of features that allow to adjust your credit scoring to the new economic reality and evaluate borrowers more accurately than ever before:

utilize 2 scorecards for evaluation (default System scorecard, and Bank Statements scorecard for when in doubt)

customize decision rules

customize scorecard items and settings

set your own bank verification expiration dates and requests' intervals

fully edit the bank account verification notifications and their frequency

If you'd like to learn more about the importance of utilizing bank statements data in credit decisioning, feel free to read our article about it here:

Boost Credit Decisioning Accuracy with Bank Statement Scoring

Remember, that TurnKey Lender solution is extremely intuitive and easy to use. Nonetheless, it has an enormous amount of functionality which we can enable or disable for you upon request. In this article, we'd just like to show you how granular the settings and how powerful our System can be on this small example.

And now let's dig in.

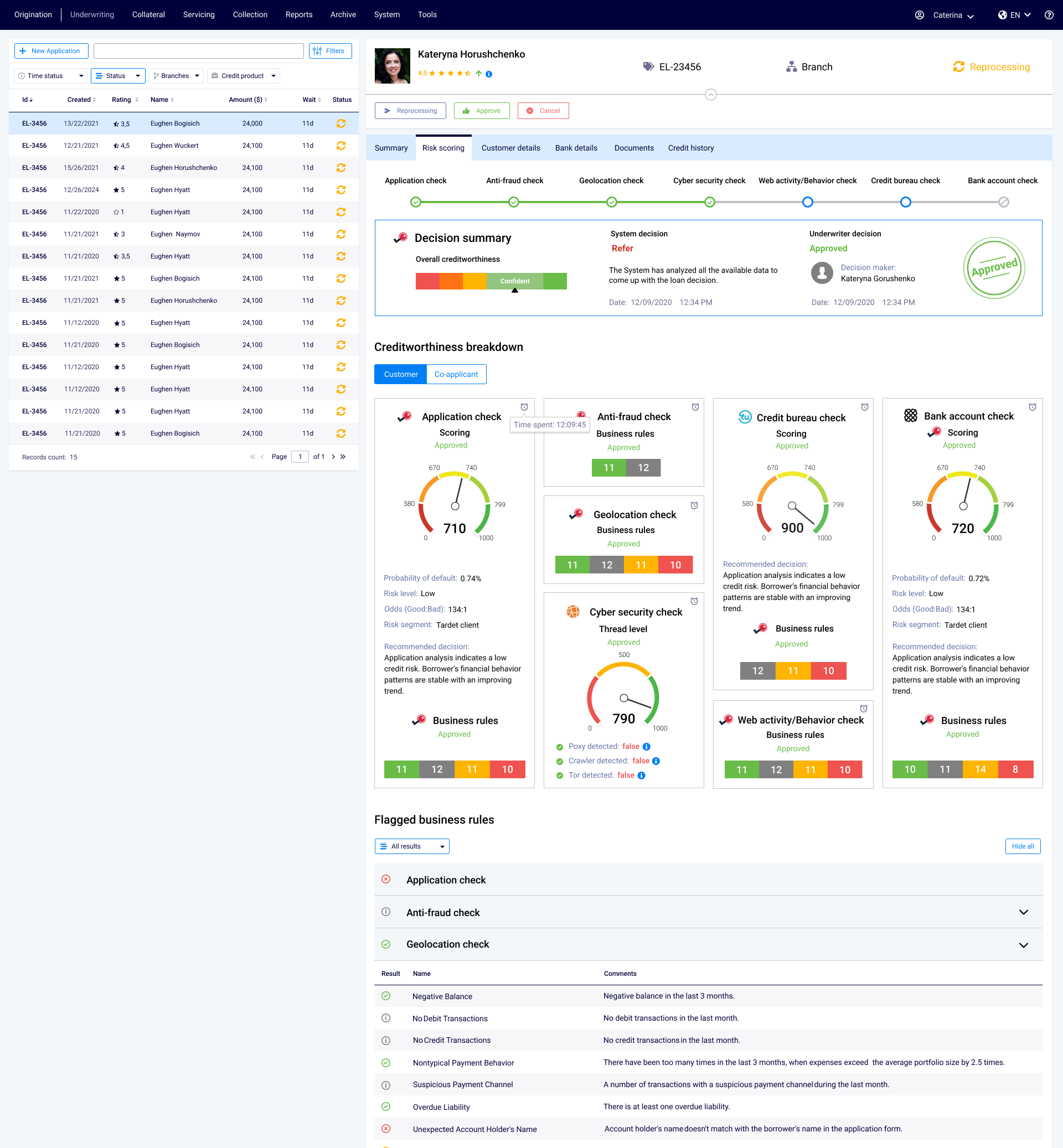

This edition of the System has an additional scorecard - Bank Statements Scorecard. It is built around the particular data points you can retrieve from a bank statement and evaluates the data using AI algorithms to provide you with a completed analysis result almost instantly.

The only delay can be on the side of the bank's database.

The first scorecard runs a basic borrower evaluation. It is conducted completely within the solution. Proprietary machine learning algorithms and deep neural networks are applied to evaluate the borrowers at this stage.

If the underwriter has doubts, they can use Bank Statements Scoring. The bank statements are collected as PDFs and are formatted to present data in the System interface in an intuitive manner that allows the originator or underwriter to make the crediting decision within seconds.

Here's how it looks in the System Dashboard:

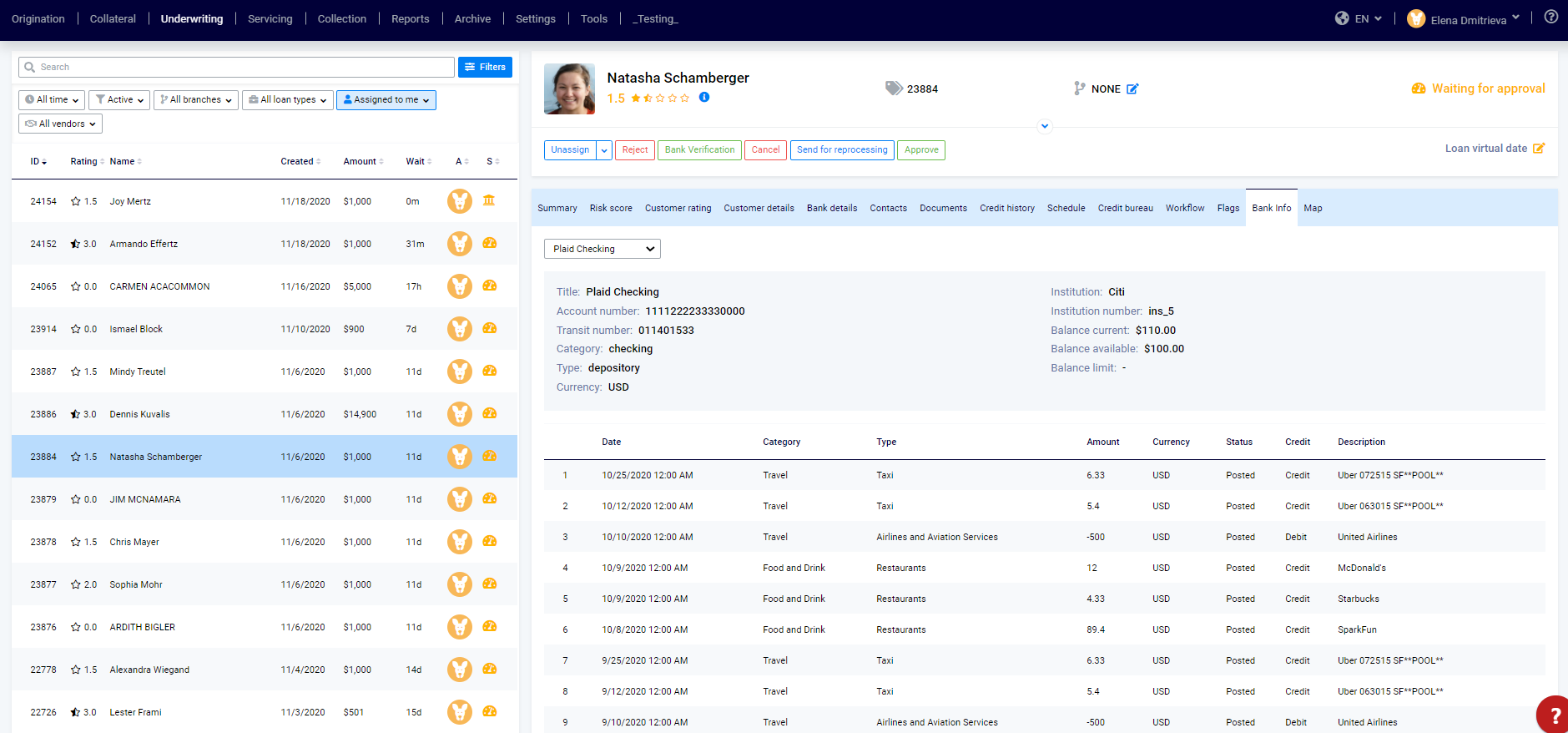

Underwriters can carry out Bank Verification of the potential borrowers with just one click. Here's how it works.

The employees with Underwriter access permission will be able to use the Bank Verification feature. One click and the application is sent for bank verification

Bank Account Verification Request notification is automatically sent to the borrower

A disclaimer in the dashboard will prompt the borrower to verify their bank account

In case the bank verification is expired, the loan application moves to the Archive. You can access it there at any time.

Bank statements can be a perfect basis for accurate credit scoring. TurnKey Lender clients who have implemented this scoring approach, make more than 80% of their credit decisions based on this data. Here are some of the features that will help you automate the work with bank statements and cut costs.

If a borrower applies for a new loan and there is already an active loan in the System, then the System won't carry out Bank Verification to make sure you don't spend extra.

You can easily specify bank providers whose data you're going to be using in System → Integrations → Bank Providers.

Verification Expiry (days) - specify the period after which you consider Bank Account Verification to de expired

Verification Reminder (days) - specify intervals for the Bank Account Verification reminders (which you can also edit).

Once a borrower verifies their bank account, the System retrieves Bank Account information from the Verification service and adds it to the list of the borrower's Payment Options. Then the System prompts the borrower to select a default payment method

In case Bank Verification is set to Do not use, the borrower should be able to add payment options manually from his personal account

Custom notifications for bank account verification request, reminder, and eexpiration.

Every time borrower verifies a bank account, a bank account statement is validated against a set of rules. The System checks the following data by default:

Negative balance

Debit transactions

Credit transactions

These data points and other behavioral data has proved to be sufficient to evaluate with high accuracy whether or not the borrower will return the loan, what risk group they are in, and what interest they need to be assigned. The System does all that automatically. And if at some point, you'd like to fully customize the scorecard to your needs, feel free to talk to your Account manager to see how we can proceed.