...

Standard Australian edition, soft pulls, repayment priority constructor, Avalara, and much more

TurnKey Lender is happy to announce a major new release – welcome Standard v.7.9.

...

And while we’re proud of all we’ve done in this iteration of Standard, we’re particularly excited about the rollout of the Australian Edition of our software. So let’s start with it.

TurnKey Lender Standard – Australian Edition

For years now, numerous clients in Australia use TurnKey Lender Standard to automate their lending processes, and it worked just fine. While credit products, decisioning, origination, servicing, collection, and reporting in Australia are pretty much the same as elsewhere, the thing that required a lot of our attention for each project were the integration with local data providers, payment providers, and other relevant services.

...

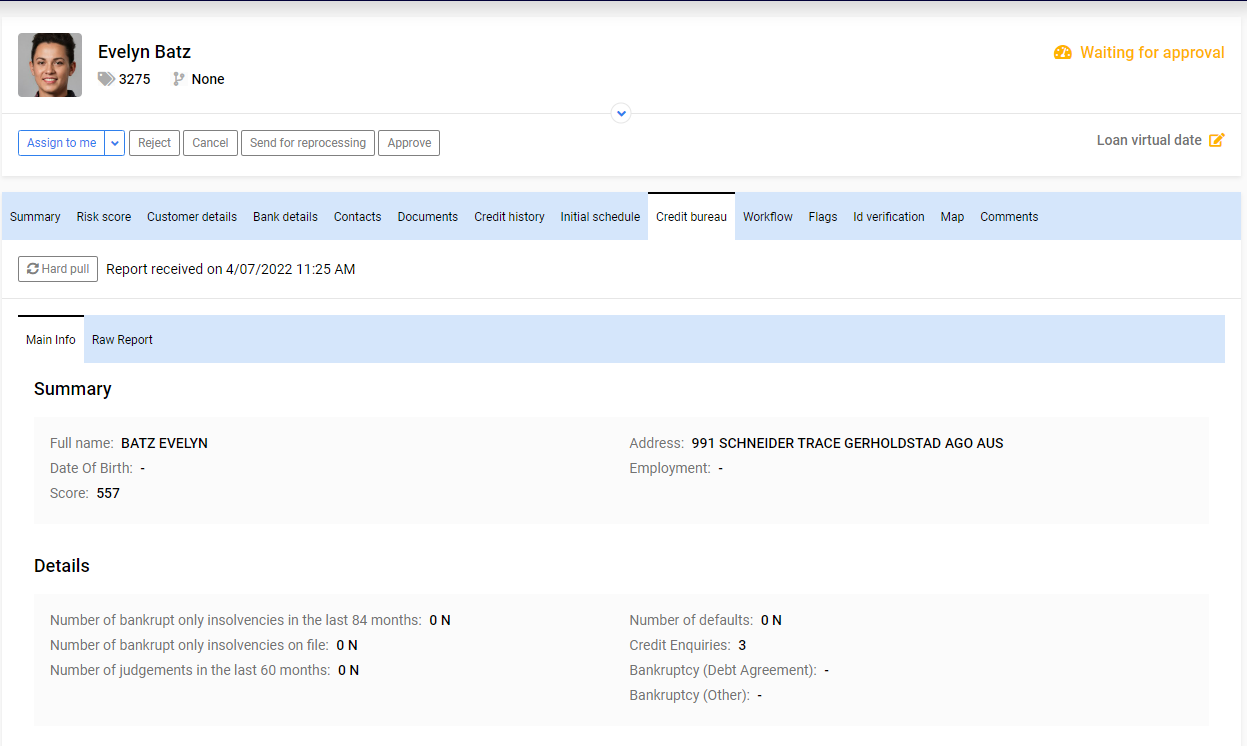

Equifax Australia– the credit bureau is the leading provider of credit information and analysis in Australia. TurnKey Lender Standard integrates with it in just a few clicks, pulls credit report data and instantly uses it in scoring and decisioning.

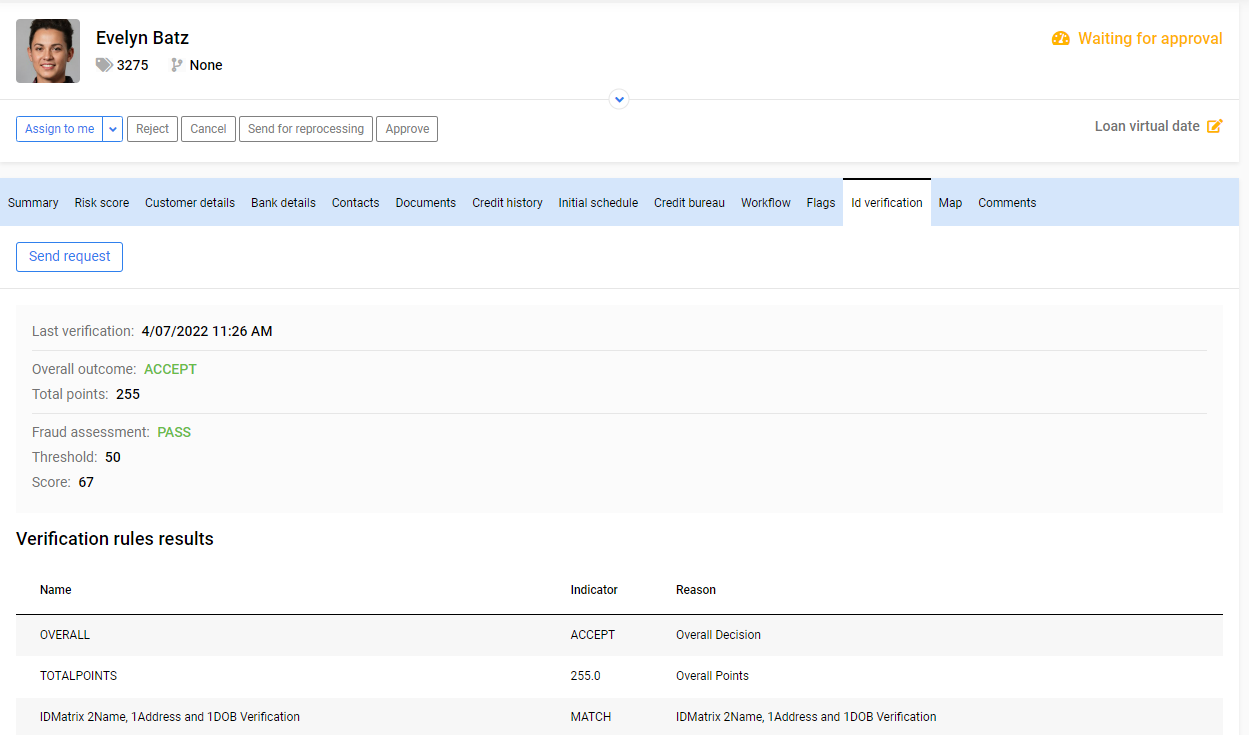

ID Matrix and Green ID– Australian Edition is integrated with these two innovative ID verification services. The data from them is used for personal checks and in decision rules. This is the first market where we roll out automated ID verification of this level. During auto processing there’s an automatic verification of borrower data in the databases.

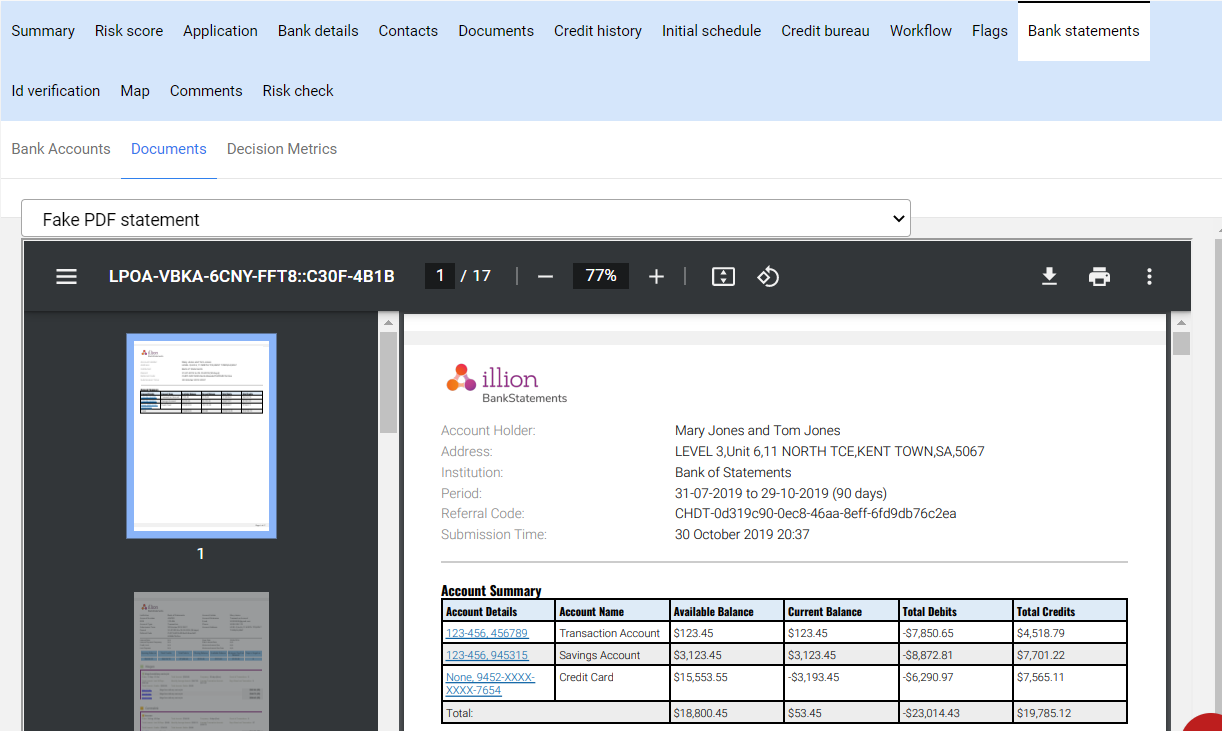

Illion– integration with Illion (an important element of Australia and New Zealand's financial ecosystem) provides an additional source of credit bureau data and bank verification. Based on Illion’s data, we’ve added new decision rules to our Decision Engine. In some parameters, Illion has even more data than similar companies in the US so Australian lenders will enjoy even better scoring, decisioning, and bank account verification.

Zepto , Fat Zebra– two of Australia’s leading and most innovative payment providers are now also pre-configured integrations of TurnKey Lender Standard.

Geoscape– with Geoscape’s location data, lenders can use instant address verification from their TurnKey Lender instance. In a nutshell, you type in an address, and the system pulls the possible variants on the fly.

...

Soft pulls - prequalify borrowers without hurting their credit

You’ve asked for it, and here it is. Starting with v.7.9, a lender that uses a credit bureau that has both soft and hard pulls can do the prequalification with just soft pulls. This allows you as a lender to be a better partner and serve your clients in a much gentler way. So even if they don’t qualify for credit with you, you won’t influence their rating.

...

We do all the possible evaluations with a soft pull to not influence the rating of the client before we approve the loan.

...

Major updates to the Calculations engine

Repayment modes constructor

Often, a payment from the borrower covers a part of the amount to be paid. Each loan installment consists of several parts and fees and an insufficient payment will only cover some of them. Depending on which parts are covered, the future payment calculations will change.

...

It used to be possible to select one of the pre-defined ways in which the calculations happen during the repayment, but this feature has been rebuilt to make the whole process flexible and extendable, more intuitive and easier to use regardless of the staff’s digital expertise level.

From now on, most specific payment features of your business model can be configured without any additional development.

...

Side/special fees

In this update, we’ve added a special buffer for fees where you can apply, store and charge them out of the general payment schedule. This functionality is commonly used in auto lending and mortgage industries as well as alternative lending.

...

A fee can be put permanently outside of the schedule so the auto charges don’t apply to it.

You can put a fee outside a schedule and move it back. So a late fee for example can be paid as a separate payment or as part of the schedule in the priority you see fit (as described before).

...

Zero balance revolving credit line

Credit lines may follow different business logic. In many cases, even when a credit line is repaid in full, it needs to stay open. Now Standard has built-in functionality for a revolving credit line with multiple disbursements. Before, when a loan was paid up, it would close automatically.

This means that, as a lender, you can offer a fully functional long-term revolving credit line with multiple disbursements and custom fees. A borrower can keep the line’s balance at zero for a while and then simply start using it again without additional steps. This significantly simplifies the process for vendors, alternative lenders, and BNPL providers.

...

Customer detail changelog – better visibility of application changes

We continue to simplify audits and improve your corporate security measures in each new release. With this new feature, we’re helping keep customer historic data systematized and protected. Starting with v.7.9, the data with all the changes made to the loan application and customer details can be found by employees directly in their workplace in a dedicated tab with intuitive historical navigation.

...

Underwriters and loan managers need access to this data at their fingertips. If a client changes their data – it‘s easier to identify and catch any fraud, as well as quality control for your internal staff.

...

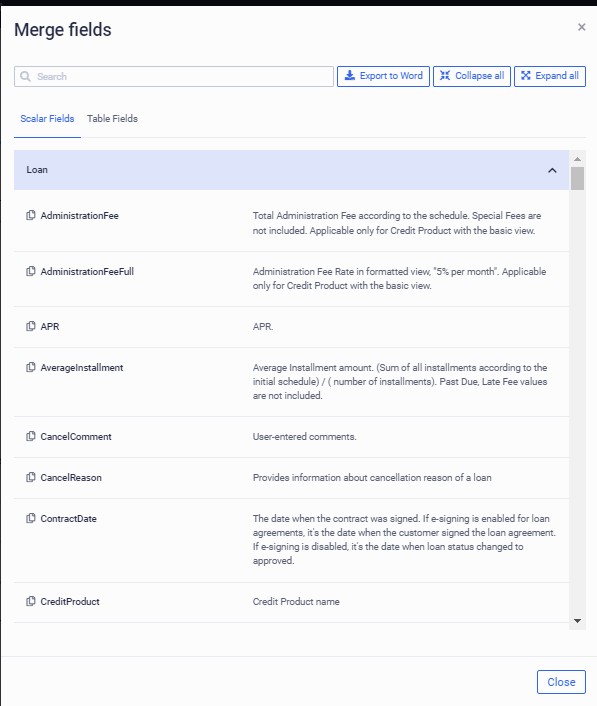

Faster custom documents creation with new merge fields lookup

When running an automated lending business, one of the more complex challenges is generating personalized documents on autopilot. Most businesses to this day have to fill the files out and send them over manually, which is simply not the 21st century way to do things.

...

No need to know the specific merge field spelling or look for it in the documentation. A back-office user can easily navigate, copy, and download the list of merge fields without prior knowledge of how to use them. The merge fields are always up to date, always there and ready to be used, and are specific to your project.

Avalara integration

Avalara integration allows us to expand the platform’s capabilities when working with retailers. Any retail business deals with sales taxes. Sales taxes in the US depend on the state, district, street, and even specific property in question, so keeping track of it is very hard.

...

Avalara is one of the biggest and best providers of sales tax data. Starting with v.7.9, we’re integrated with it, we receive data automatically from the verified sources and this is an important step forward for retailers looking to simplify their in-house BNPL process. You don’t need to know anything about sales taxes – just connect Avalara integration and lend.

...

Other improvements

LoanPaymentPro integration - LoanPaymentPro is a payment processor servicing the debt repayment industry and we’re happy to report that a pre-configured integration with this service is added in v.7.9.

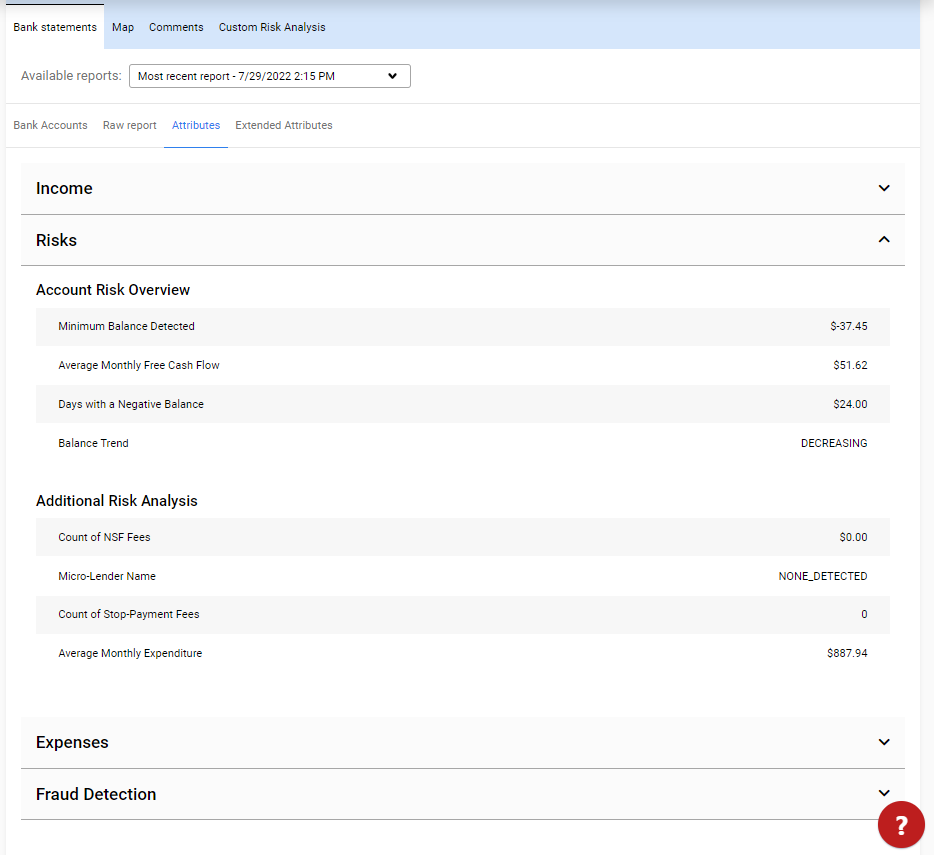

Flinks attributes – improving our existing integration, our scoring models learned to analyze and interpret a lot of new data we receive from the Flinks bank statements. We've added 100+ new parameters for credit scoring and analysis. Our Decision Engine now parses more data from the bank statements, and gets more trends and inputs which can be used in the decision-making process.

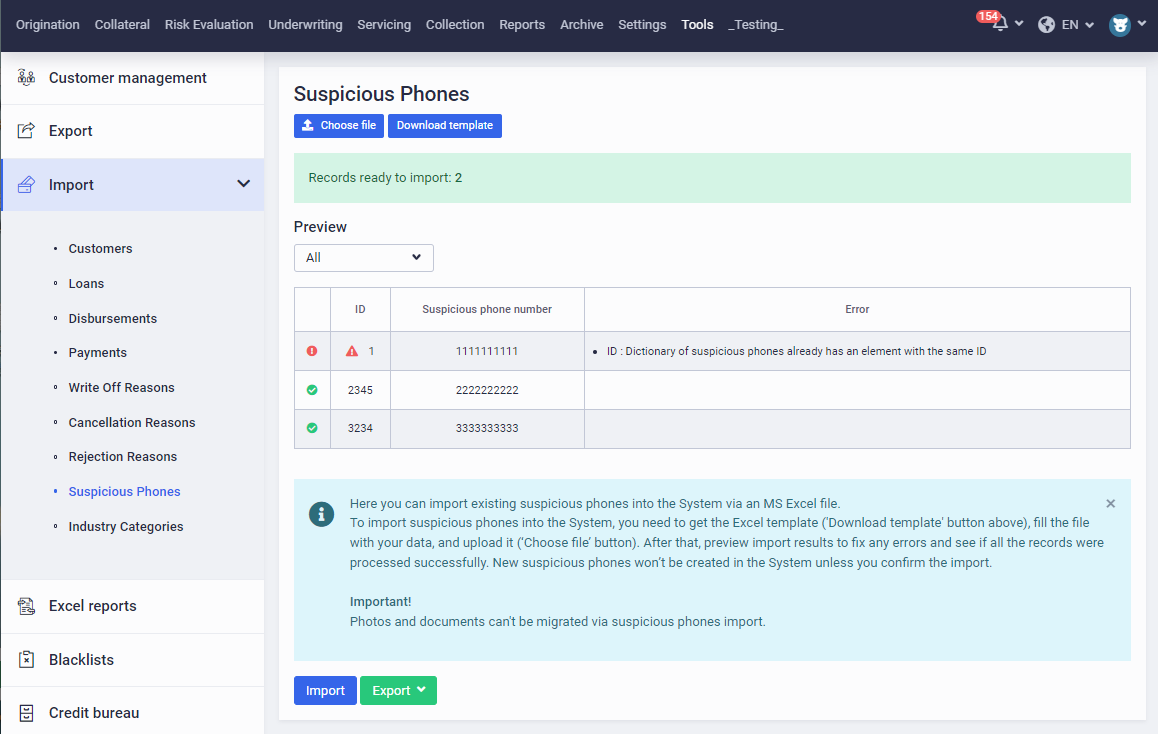

Import dictionary – often when migrating to our platform, a business has knowledge and data accumulated. This can include suspicious phones, rejection reasons, cancellation reasons, industry categories, etc. Now they can simply import all that data and keep working with the terminology and data they are used to.

APR calculation (Canada) - credit product builder is now fully compliant with Canada’s official APR regulations.

DocuSign integration - with the new pre-configured DocuSign integration, the new connection can be set up in a matter of business allowing borrowers and co-applicants to work with this e-signature service as soon as the integration is live.

New reports, filters, and smart markers were added.

Comment feature improvements – Back-office staff can now interact better with each other inside each loan application. Similar to how it works for comments in a shared online document, authorized users can see comments left by other employees and can communicate with each other within the application, thus streamlining resolution of any arising issues and keeping all relevant data in one place.

New Back-office notifications – in one of our recent releases, we've added a capacity to send notifications to back-office users, and now you’ll be able to set up many new automated messages for vendors and back-office, saving their time and making sure that they are aware of any necessary information.

The loan offers UI has been significantly redesigned and simplified, improving the experience for your clients

...